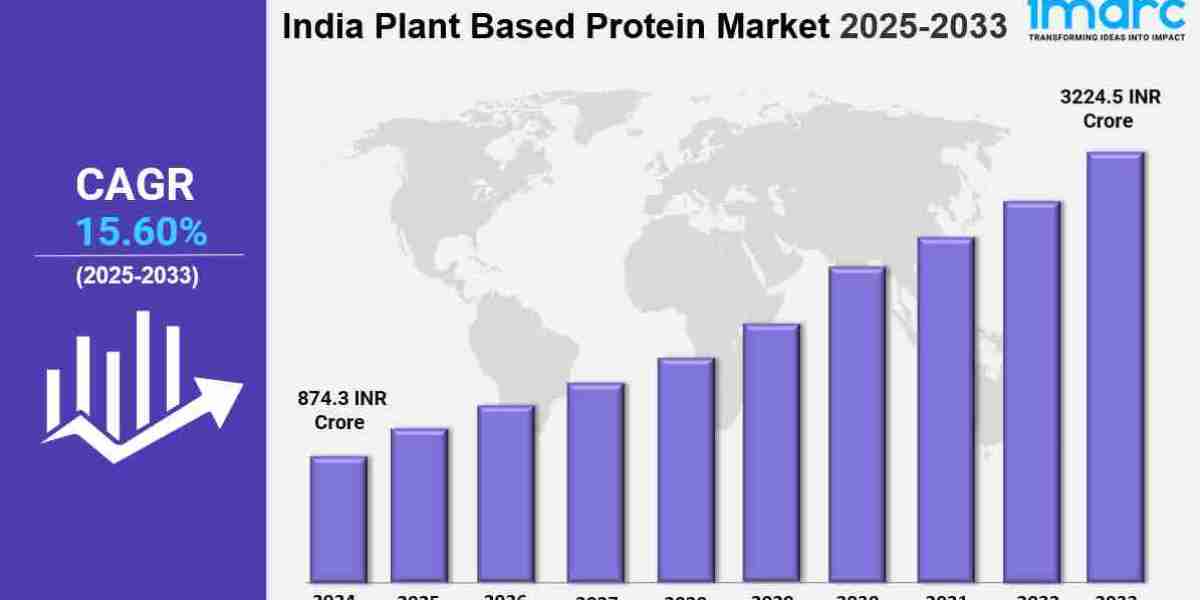

Market Overview 2025-2033

India plant based protein market size reached 874.3 INR Crore in 2024. Looking forward, IMARC Group expects the market to reach 3224.5 INR Crore by 2033, exhibiting a growth rate (CAGR) of 15.60% during 2025-2033. The market is expanding quickly, driven by increasing health consciousness and a growing preference for sustainable, plant-based diets. Rising demand for vegan and vegetarian options, along with innovations in food technology, are key factors boosting the sector's growth.

Key Market Highlights:

✔️ Rapid market growth driven by increasing health consciousness and dietary shifts towards plant-based alternatives

✔️ Rising demand for soy, pea, and almond-based protein products

✔️ Expanding availability through retail, e-commerce, and food service sectors

Request for a sample copy of the report: https://www.imarcgroup.com/india-plant-based-protein-market/requestsample

India Plant Based Protein Market Trends and Driver:

More Indian consumers are becoming aware of health and wellness. This shift is driving the demand for india plant based protein market product. As people pay more attention to their diets, they are moving towards healthier eating. This includes choosing plant-based proteins over animal-based ones. Concerns about obesity, heart disease, and other health issues are fueling this change.

Younger generations, especially millennials and Gen Z, are more interested in vegetarian and vegan diets. Social media and celebrity endorsements heavily influence them. This change in demographics is pushing food manufacturers to innovate. They are expanding their range of plant-based products, like meat substitutes, protein-rich snacks, and dairy alternatives.

As health consciousness rises, consumer preferences are changing. This shift is reshaping India’s food industry, making plant-based proteins a key market segment. A key factor shaping the plant-based protein market in India is environmental sustainability. Climate change and the impact of animal agriculture are clear concerns for consumers. Many are now looking for sustainable food choices. Plant-based proteins are seen as eco-friendly options. Plant-based farming uses less water and land.

It also emits fewer greenhouse gases than livestock farming. This awareness drives consumers and businesses to prioritize sustainability in food choices. Many brands now highlight their commitment to eco-friendly practices. They often showcase the benefits of their plant-based products. This trend appeals to eco-conscious shoppers and encourages investment in sustainable agriculture. Therefore, sustainability is key to the demand and growth of the plant-based protein market in India.

Innovation plays a pivotal role in the growth of the plant-based protein market in India. As competition rises among food brands, product diversification is key. Companies are looking into plant proteins from lentils, peas, chickpeas, and quinoa. This helps them create various products that suit different consumer tastes. Advances in food technology let plant-based meat alternatives mimic animal products in taste and texture. This appeals to vegetarians, vegans, and flexitarians—those cutting back on meat. The market is expanding with ready-to-eat meals, protein bars, and fortified plant-based drinks. Ongoing innovation and product variety are crucial for attracting consumers in India's plant-based protein market.

The india plant-based protein market is changing quickly. In 2024, there's a clear rise in the variety and availability of plant-based protein products. Both local and international brands drive this growth. Consumers want convenience, leading to more ready-to-eat plant-based meals and snacks for busy lives. There's also a strong push for clean label products. Shoppers prefer items without artificial additives and preservatives. This trend makes brands more transparent about their ingredient sourcing and production methods.

E-commerce platforms have made these products easier to find, reaching consumers in tier II and III cities. Social media and influencer marketing are key in shaping consumer views and boosting demand. Overall, the plant-based protein market in India is growing rapidly. Trends suggest a strong future as consumers focus on health, sustainability, and convenience in what they eat.

India Plant Based Protein Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Source:

Soy Protein

Pea Protein

Wheat Protein

Rice Protein

Others

Breakup by Type:

Concentrates

Isolates

Textured

Breakup by Nature:

Conventional

Organic

Breakup by Application:

Health and Fitness

Food and Beverages

Pharmaceutical

Others

Breakup by Region:

North India

West and Central India

South India

East and Northeast India

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145