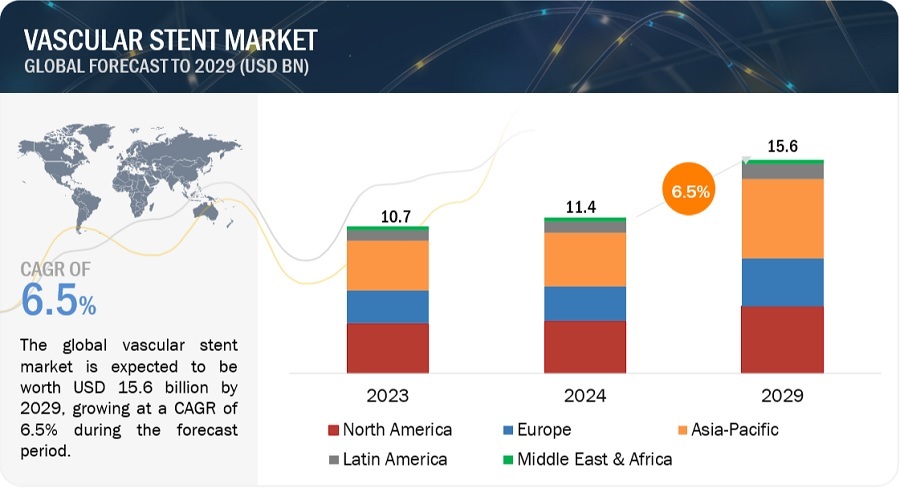

The vascular stents market is anticipated to grow from USD 11.4 billion in 2024 to USD 15.6 billion by 2029, with a CAGR of 6.5%. This growth is driven by increasing cases of vascular diseases and a higher adoption of minimally invasive procedures like angioplasty. The market is further supported by advancements in bioresorbable vascular scaffold stents, which offer temporary support and reduce adverse reactions. However, stringent regulatory requirements and the risk of complications from stenting procedures pose challenges. In 2023, covered stents and femoral artery stents led the market in terms of technology and product type, respectively. Hospitals are the largest end users, reflecting the high demand for stent-based treatments in cardiovascular care, with North America holding the largest market share due to high incidence rates of cardiovascular diseases. Key players include Medtronic, Abbott, Boston Scientific, and several others across various regions, indicating a competitive and evolving market landscape.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=199869009

Browse in-depth TOC on "Vascular Stents Market"

620 - Tables

53 - Figures

426 - Pages

Technological Advancements

The vascular stent market is segmented by technology into covered stents, drug-eluting stents, bare metal stents, and bioabsorbable stents. As of 2023, drug-eluting stents hold the largest market share due to their clinical benefits, including a lower incidence of restenosis. These stents are coated with medication that helps prevent blood clots and reduces the likelihood of artery re-narrowing post-angioplasty. This effectiveness in minimizing restenosis rates contributes to their growing popularity, thus driving their market dominance.

Product Segment Analysis

The market is also divided by product type into coronary stents, peripheral stents, and EVAR stent grafts. Coronary stents lead the market due to the high prevalence of coronary artery disease (CAD) globally. CAD, which affects the coronary arteries and is linked to atherosclerosis, significantly drives the demand for coronary stents. With coronary heart disease being a major cause of death, particularly in the US, the market for coronary stents is expected to grow accordingly.

Mode of Delivery

The vascular stent market is further categorized by mode of delivery into balloon-expandable stents and self-expanding stents. In 2023, balloon-expandable stents dominated the market. These stents offer precise placement and strong radial force to maintain vessel patency, thanks to their balloon-based expansion mechanism. This feature reduces the risk of overexpansion and vessel damage, contributing to their popularity and leading market share.

Regional Insights

Geographically, the Asia Pacific region is the fastest-growing segment in the vascular stents market. The rising prevalence of cardiovascular diseases, driven by an aging population, is a significant factor. The Economic and Social Commission for Asia and the Pacific (ESCAP) reports that 60% of the global elderly population resides in this region, a number expected to double by 2050. This demographic trend, coupled with improvements in healthcare infrastructure and increased cardiovascular health awareness, is fueling the rapid growth of the vascular stents market in Asia Pacific.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=199869009

Key Market Players

The vascular stent market is highly consolidated, with several key players dominating the field. Major companies include Medtronic Plc (Ireland), Abbott Laboratories (US), Boston Scientific Corporation (US), B Braun SE (Germany), Terumo Corporation (Japan), Biotronik SE & Co.KG (Germany), and Shanghai Microport Medical (Group) Co., Ltd (China), among others. These companies are known for their advanced technologies and substantial investments in research and development.

Medtronic Plc (Ireland)

Medtronic Plc is a global leader in medical technology, offering a broad range of vascular stents designed for treating conditions such as endovascular aortic aneurysms and coronary artery disease. With operations in over 150 countries, Medtronic's significant R&D investments drive continuous innovation in vascular stents, reinforcing its competitive edge and commitment to improving patient outcomes through advanced solutions and FDA-approved products.

Abbott Laboratories (US)

Abbott Laboratories is a major healthcare player specializing in product development, manufacturing, and sales across several sectors, including medical devices. Abbott's range of vascular stents includes carotid, Supera Peripheral, Xience drug-eluting, and peripheral vascular stents. The company's focus on innovation is evident in its substantial R&D investments and recent advancements like bioabsorbable stents, positioning Abbott as a leader in vascular care with a broad product portfolio and comprehensive market strategies.

Boston Scientific Corporation (US)

Boston Scientific Corporation is a global medical device company with a strong presence in the vascular stent market through its Cardiovascular segment. In 2023, the company increased its R&D spending by USD 91 million, reflecting a 7% rise from the previous year. Boston Scientific's commitment to innovation and market expansion is supported by its acquisitions of stent manufacturing firms, which enhance its product offerings and market reach, ensuring its competitiveness in the industry.

For more information, Inquire Now!