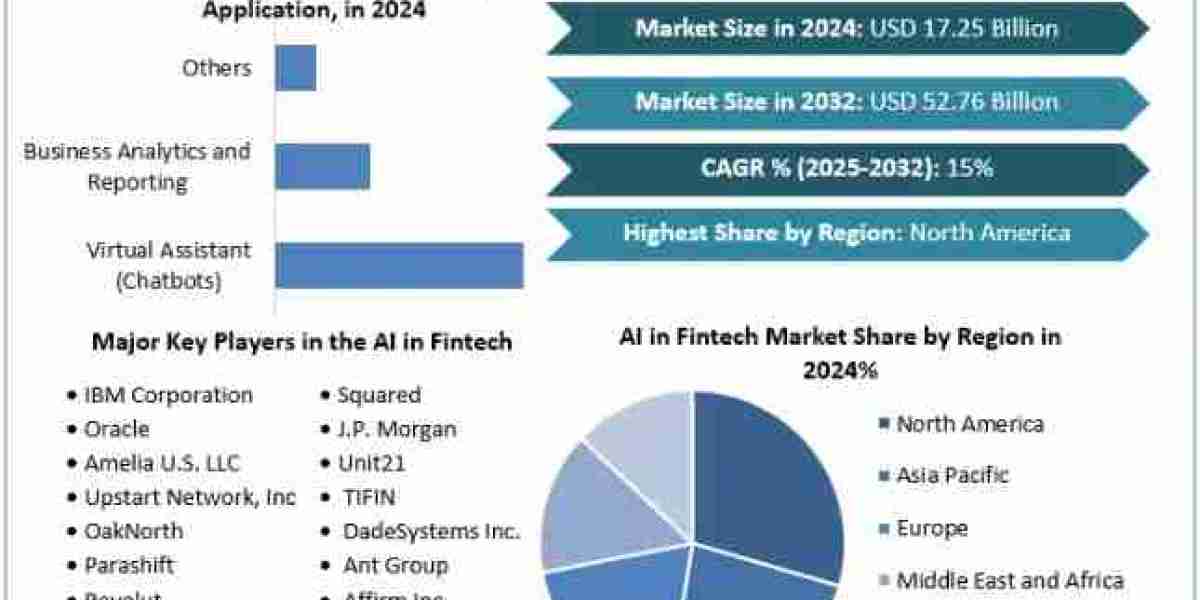

AI in Fintech Market Demand was valued at USD 17.25 Billion. in 2024 and the total Global AI in Fintech Market revenue is expected to grow at a CAGR of 15 % from 2025 to 2032, reaching nearly USD 52.76 Billion.

Market Definition and Estimation

The AI in Fintech market refers to the integration of artificial intelligence technologies into financial services to enhance efficiency, accuracy, and customer experience. These applications include virtual assistants, fraud detection systems, business analytics, and risk management tools. The market size has been estimated using a comprehensive analysis of industry trends, segmental revenue, and regional developments.

Claim your sample copy of this report instantly! https://www.stellarmr.com/report/req_sample/AI-in-Fintech-Market/1564

Market Growth Drivers and Opportunities

Several key factors are driving the robust growth of AI adoption in the Fintech industry:

- Technological Advancements: Innovations in AI, including machine learning, natural language processing (NLP), and predictive analytics, are transforming financial operations by enabling automated decision-making and improved customer service.

- Increased Adoption by Financial Institutions: Banks and financial firms are leveraging AI to streamline operations, detect fraud, and enhance risk management. The integration of AI-driven chatbots and automated advisory services has significantly improved efficiency.

- Enhanced Security and Fraud Detection: AI's ability to detect anomalies in real-time has led to improved security measures, reducing risks associated with cyber fraud, unauthorized transactions, and identity theft.

- Personalized Financial Services: AI is enabling customized financial solutions, offering tailored banking experiences through data-driven insights, improving user engagement and customer retention.

- Growth in Digital Banking and Payments: The expansion of digital banking, mobile payments, and blockchain technology is further fueling the demand for AI-powered financial solutions.

Segmentation Analysis

The AI in Fintech market is segmented based on deployment mode, components, and application:

By Deployment Mode:

- Cloud-Based AI Solutions: Offering scalability and real-time analytics, cloud-based AI adoption is increasing among financial firms.

- On-Premises AI Solutions: Provides data security and regulatory compliance, particularly preferred by large enterprises.

By Components:

- Solutions: AI-driven software such as predictive analytics, robo-advisors, and fraud detection tools.

- Services: Consulting, integration, and maintenance services for AI applications in financial institutions.

By Application:

- Virtual Assistants (Chatbots): AI-powered tools used for customer support and automated financial assistance.

- Business Analytics and Reporting: AI-driven financial insights and performance tracking.

- Risk and Compliance Management: AI tools for regulatory compliance, fraud prevention, and credit risk assessment.

To find more information about this research, please visit: https://www.stellarmr.com/report/AI-in-Fintech-Market/1564

Regional Insights

- North America: The region dominates the AI in Fintech market due to early adoption of AI solutions, strong investment in digital banking, and the presence of major financial institutions. The U.S. leads in AI-driven Fintech innovations, with banks integrating AI-powered chatbots, automated fraud detection, and credit scoring systems.

- Europe: Germany is a key market in AI-driven financial solutions, with financial firms leveraging AI for regulatory compliance and fraud detection. The European Union’s initiatives for AI governance and digital finance transformation are expected to further drive AI adoption.

- Asia-Pacific: Rapid growth in the Fintech sector across China, India, and Southeast Asia is boosting AI adoption. Rising internet penetration, government initiatives for digital banking, and AI-powered payment solutions are accelerating market expansion.

Competitive Landscape

The global AI in Fintech market features major players driving innovation and competition:

- IBM Corporation: A leader in AI-powered financial analytics and cloud computing solutions.

- Oracle: Offers AI-driven financial applications and risk management solutions for banking institutions.

- Upstart Network, Inc.: Specializes in AI-based lending solutions and credit risk assessment models.

- Ant Group: A leading Fintech firm integrating AI for digital payments, risk analysis, and personalized financial services.

- Affirm Inc.: Provides AI-driven financial products for digital payments and alternative lending services.

These companies are focusing on strategic partnerships, AI innovation, and expansion of their AI-driven service portfolios to strengthen their market presence. The competitive landscape is characterized by increased investment in AI research and development, collaborations with Fintech startups, and AI-powered regulatory compliance solutions.

Conclusion

The global AI in Fintech market is set for remarkable growth, with an anticipated valuation of USD 39.90 billion by 2030. Factors such as technological advancements, increasing AI adoption, the demand for enhanced financial security, and the rise of personalized digital banking solutions are fueling this expansion. Market leaders are expected to continue innovating and integrating AI-powered financial tools, ensuring a dynamic and competitive Fintech landscape in the coming years.

Our Trending Report :

Germany Esports Market https://www.stellarmr.com/report/Germany-Esports-Market/1581

Mexico Esports Market https://www.stellarmr.com/report/Mexico-Esports-Market/1585

About Stellar Market Research:

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include science and engineering, electronic components, industrial equipment, technology, and communication, cars, and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Stellar Market Research:

S.no.8, h.no. 4-8 Pl.7/4, Kothrud,

Pinnac Memories Fl. No. 3, Kothrud,

Pune, Maharashtra, 411029

sales@Stellarmarketresearch.com

+91 20 6630 3320, +91 9607365656