India's Non-Life Insurance Market Poised for Significant Growth by 2029

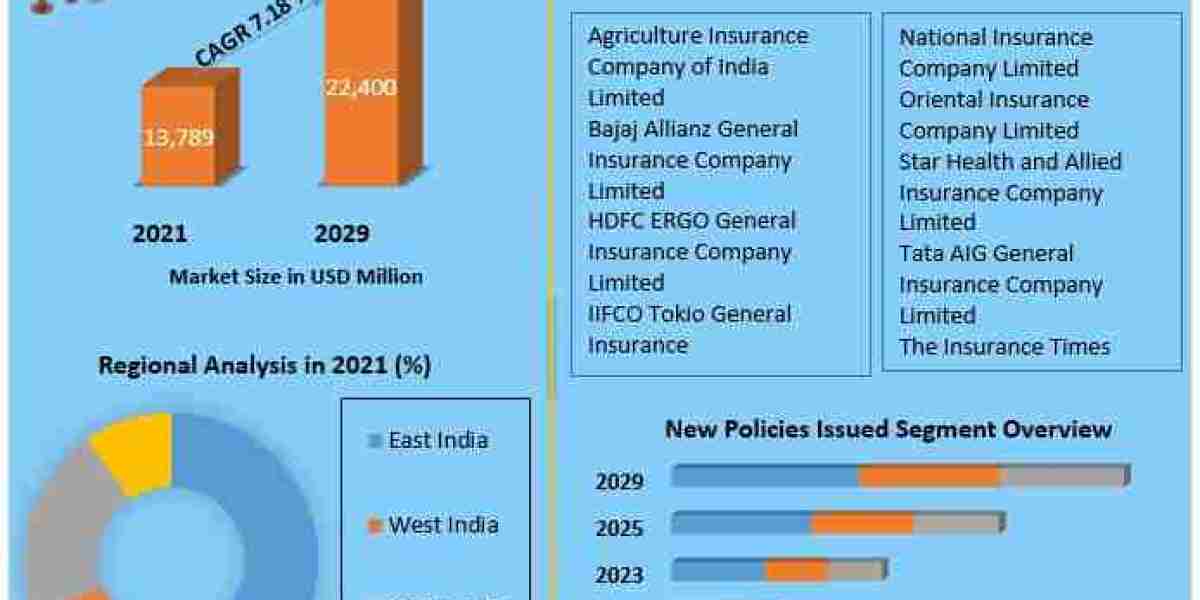

Pune, Maharashtra, India – February 20, 2025 – The Indian non-life insurance sector is on a trajectory of robust expansion, with market valuations projected to escalate from US$13,789 million in 2021 to an estimated US$22,400 million by 2029. This growth corresponds to a Compound Annual Growth Rate (CAGR) of 7.18% over the forecast period.

Get your sample copy of this report now: https://www.maximizemarketresearch.com/request-sample/42091/

Market Definition and Scope

Non-life insurance, also referred to as general, property, or casualty insurance, encompasses policies that provide financial compensation for losses arising from specific events such as medical emergencies or property damage. Unlike life insurance, non-life insurance policies typically cover individuals, legal liabilities, and properties, with policy durations often spanning one year, subject to the type of coverage.

Drivers of Growth and Emerging Opportunities

Several factors are propelling the expansion of India's non-life insurance market:

- Automotive Industry Expansion: The burgeoning automotive sector, coupled with mandatory motor insurance regulations, is significantly boosting the motor insurance segment.

- Healthcare Sector Advancements: A heightened awareness of health and a shift towards preventive healthcare are driving demand for health insurance products.

- Rising Disposable Incomes: The increasing purchasing power of the middle-class population, along with a growing young working demographic, is leading to higher adoption rates of various non-life insurance products.

- Technological Integration: The incorporation of digital technologies and artificial intelligence is streamlining insurance processes, enhancing customer experiences, and creating new product offerings.

Download your sample copy of this report today: https://www.maximizemarketresearch.com/request-sample/42091/

Segmentation Analysis

The Indian non-life insurance market is segmented based on product types, new policies issued, distribution channels, and regions. Key segments include:

- Product Types: Motor insurance, health insurance, property insurance, and casualty insurance.

- Distribution Channels: Direct sales, insurance brokers, bancassurance, and digital platforms.

- Geographical Regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America.

Global Perspective: Country-Level Insights

While the focus is on India's market, understanding global trends provides valuable context:

- United States: The U.S. non-life (property and casualty) insurance sector reported a US$9.3 billion underwriting gain in the first quarter of 2024, recovering from an US$8.5 billion loss in the same period the previous year. This turnaround is attributed to multiple rate increases in personal lines outpacing claims costs.

- Germany: Germany boasts Europe's largest domestic non-life insurance market and ranks fifth globally. The market is projected to reach a size of US$160.40 billion by 2025.

Secure your sample copy of this report immediately: https://www.maximizemarketresearch.com/request-sample/42091/

Competitive Landscape

The Indian non-life insurance market is characterized by a mix of public and private sector companies, with key players including:

- Public Sector: New India Assurance Co. Ltd., National Insurance Co. Ltd., Oriental Insurance Co. Ltd., and United India Insurance Co. Ltd.

- Private Sector: ICICI Lombard General Insurance Co. Ltd., Bajaj Allianz General Insurance Co. Ltd., HDFC ERGO General Insurance Co. Ltd., and Tata AIG General Insurance Co. Ltd.

These companies are increasingly leveraging digital platforms, enhancing customer service, and expanding their product portfolios to gain a competitive edge.

Curious about market analysis? The research report summary offers valuable insights: https://www.maximizemarketresearch.com/market-report/india-non-life-insurance-market/42091/

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656