Market Overview 2032

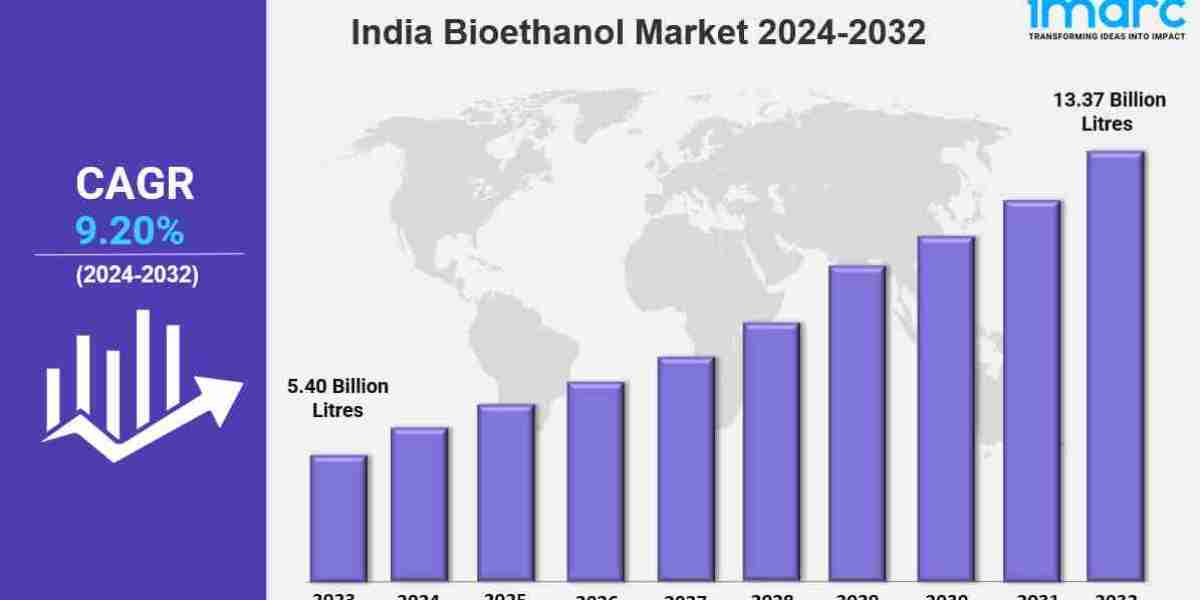

India bioethanol market size reached 5.40 Billion Litres in 2023. Looking forward, IMARC Group expects the market to reach 13.37 Billion Litres by 2032, exhibiting a growth rate (CAGR) of 9.20% during 2024-2032. The market is growing rapidly due to increasing demand for cleaner, renewable energy sources. Government initiatives promoting biofuels, coupled with rising environmental concerns and energy security needs, are driving significant expansion in this sector.

Key Market Highlights:

✔️ Strong market growth driven by rising demand for renewable and cleaner fuel alternatives

✔️ Increasing government support and ethanol blending mandates boosting production

✔️ Expanding adoption of bioethanol in transportation and industrial applications

Request for a sample copy of the report: https://www.imarcgroup.com/india-bioethanol-market/requestsample

India Bioethanol Market Trends and Driver:

The India bioethanol market is experiencing remarkable growth, driven by the government's push for energy security and reduced reliance on fossil fuels. A key factor fueling this expansion is the National Biofuel Policy, which targets a 20% ethanol blend in petrol by 2025. This policy has encouraged bioethanol production from sugarcane, corn, and agricultural waste by offering financial incentives and subsidies to farmers and manufacturers. Additionally, the Ethanol Blended Petrol (EBP) program has accelerated demand, as oil marketing companies are required to mix ethanol with petrol. These initiatives have led to increased investment in bioethanol infrastructure, strengthening the India bioethanol market growth.

Technological advancements are also shaping India bioethanol market trends, making production more efficient and cost-effective. Innovations in fermentation techniques, enzyme efficiency, and feedstock processing have significantly enhanced ethanol yield and sustainability. The rise of second-generation bioethanol, derived from non-food sources such as agricultural and municipal waste, addresses both production scalability and food security concerns. Improved distillation and purification methods have further boosted bioethanol quality, solidifying its role as a viable alternative to fossil fuels. As these technologies continue to evolve, production costs are expected to decline, making bioethanol an even more attractive energy source.

Growing environmental awareness is another crucial factor driving the India bioethanol market share. Rising concerns over air pollution and climate change are pushing consumers and businesses toward cleaner fuel alternatives. Additionally, fluctuating fossil fuel prices have incentivized industries to explore bioethanol as a cost-effective and sustainable option. The automotive sector is adapting to this shift by developing vehicles that can run on higher ethanol blends, reflecting the changing preferences of eco-conscious consumers. These advancements underscore bioethanol’s increasing importance in India’s transition to greener energy solutions.

By 2024, the government's 20% ethanol blending target is expected to spur further investments, particularly in agriculturally rich states. The push to lower greenhouse gas emissions and expand the use of renewable energy is also accelerating bioethanol adoption across transportation and industrial sectors.

However, the rise of electric vehicles (EVs) presents both challenges and opportunities for the India bioethanol market. While EV adoption may reduce the demand for traditional fuel-based vehicles, it also encourages bioethanol producers to innovate and diversify. As sustainability becomes a key priority for consumers, bioethanol is emerging as a crucial alternative fuel. The evolving India bioethanol market reflects a combination of government policies, technological progress, and shifting consumer behaviors, setting the stage for a cleaner and more sustainable energy future.

India Bioethanol Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2023

Historical Year: 2018-2023

Forecast Year: 2024-2032

Breakup by Type:

Sugarcane-based Ethanol

Cellulosic Ethanol

Starch-based Ethanol

Others

Breakup by Fuel Blend:

E10

E20 and E25

E70 and E75

E85

Others

Breakup by Generation:

First Generation

Second Generation

Third Generation

Breakup by End Use Industry:

Automotive and Transportation

Power Generation

Pharmaceutical

Food and Beverage

Cosmetics and Personal Care

Others

Breakup by Region:

North India

West and Central India

South India

East and Northeast India

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145