Global WealthTech Solutions Market Analysis Poised for Transformative Growth, Projected to Reach USD 23.48 Billion by 2030 – Maximize Market Research

1. Market Estimation & Definition

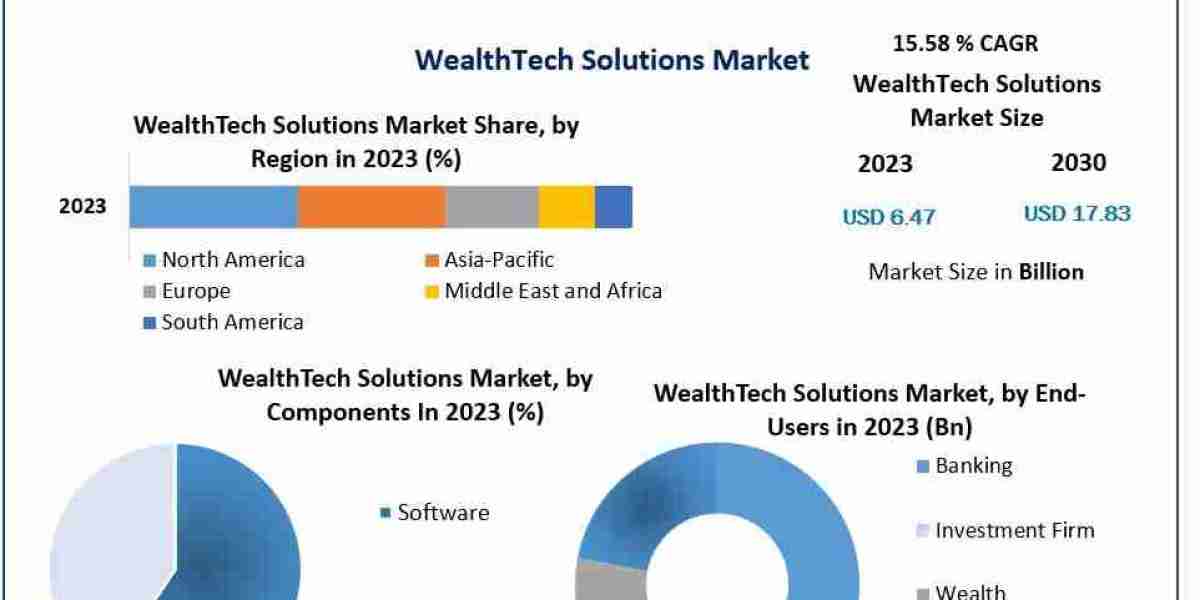

The Global WealthTech Solutions Market was valued at USD 8.51 billion in 2023 and is projected to reach USD 23.48 billion by 2030, growing at a CAGR of 15.65% during the forecast period. WealthTech (Wealth Technology) represents a new wave of digital solutions transforming wealth management and financial advisory services by leveraging advanced technologies such as Artificial Intelligence (AI), Big Data, Machine Learning (ML), and Blockchain.

WealthTech Solutions refer to technology-driven platforms and software designed to optimize asset management, financial planning, investment advisory, and portfolio management services. The solutions cater to retail investors, high-net-worth individuals (HNWI), robo-advisory services, and private banking sectors.

Download your sample copy of this report today: https://www.maximizemarketresearch.com/request-sample/167061/

2. Market Growth Drivers & Opportunity

Key Growth Drivers:

- Increasing Digitalization of Financial Services: The global adoption of digital financial services post-pandemic has accelerated the demand for tech-enabled wealth management platforms.

- Rise in Robo-Advisors: Automated investment platforms with AI-driven portfolio management are gaining popularity among millennials and Gen Z investors.

- Customization & Personalization Trends: Growing consumer preference for personalized investment advice is driving the integration of AI and Big Data in WealthTech.

- Increasing Number of HNWIs: The rising global population of high-net-worth individuals boosts demand for advanced digital wealth management services.

Opportunities:

- Integration of Blockchain & Crypto Assets: Blockchain-based wealth management solutions offer transparency, efficiency, and security.

- Expanding Emerging Markets: Untapped markets in Asia-Pacific and Latin America present significant growth potential.

- Adoption of AI & Machine Learning: AI enables predictive analytics and automated advisory services, improving customer experience.

- Collaboration between FinTech & Traditional Banks: Partnerships and acquisitions create hybrid WealthTech models with combined strengths.

Secure your sample copy of this report immediately: https://www.maximizemarketresearch.com/request-sample/167061/

3. Segmentation Analysis

By Deployment Mode:

- On-Premise

- Cloud-Based (Dominates the market with increased adoption due to cost-effectiveness, scalability, and remote access)

By End User:

- Banks

- Investment Firms

- Trading Companies

- Others

Investment Firms hold the largest market share owing to their early adoption of WealthTech solutions for portfolio optimization and risk assessment.

By Advisory Mode:

- Human Advisory

- Robo Advisory

- Hybrid Advisory

Robo Advisory is expected to register the highest growth due to automation, lower fees, and increased accessibility for retail investors.

4. Country-Level Analysis

United States WealthTech Solutions Market:

- The US leads the WealthTech Solutions Market due to its advanced financial ecosystem and early technology adoption.

- Increasing investments in AI-powered Robo-Advisors, Blockchain-based platforms, and personalized wealth management tools fuel growth.

- Presence of key players like Betterment, Wealthfront, and Robinhood strengthens the US market dominance.

Germany WealthTech Solutions Market:

- Germany is emerging as a prominent market in Europe for WealthTech adoption.

- The growth is driven by a tech-savvy population, rising fintech startups, and regulatory support.

- Digital financial literacy initiatives and rising demand for Robo-Advisory platforms are key trends.

Curious to peek inside? Grab your sample copy of this report now: https://www.maximizemarketresearch.com/request-sample/167061/

5. Competitor Analysis

Key Players in the Global WealthTech Solutions Market:

Company Name | Strategic Focus |

Wealthfront | Automated investment solutions |

Robinhood | Commission-free trading and wealth management |

Betterment | Robo-Advisory and digital portfolio management |

FIS Global | Enterprise wealth management platforms |

Fidelity Investments | Hybrid advisory and wealth tech integration |

Addepar | Portfolio management analytics for HNWIs |

Bambu | Robo-Advisory solutions for financial advisors |

SigFig | AI-powered wealth management |

Temenos | Cloud-based wealth management software |

InvestCloud | Digital wealth platforms for enterprise clients |

Competitive Landscape Trends:

- Strategic partnerships, mergers, and acquisitions dominate the market.

- Investment in AI, Blockchain, and Robo-Advisory services is a key focus.

- Startups are disrupting traditional wealth management with agile, customer-centric solutions.

Want market insights? Read the summary of the research report for essential data:

https://www.maximizemarketresearch.com/market-report/wealthtech-solutions-market/167061/ |

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656