Global Wind Turbine Rotor Blade Industry: Key Statistics and Insights in 2025-2033

Summary:

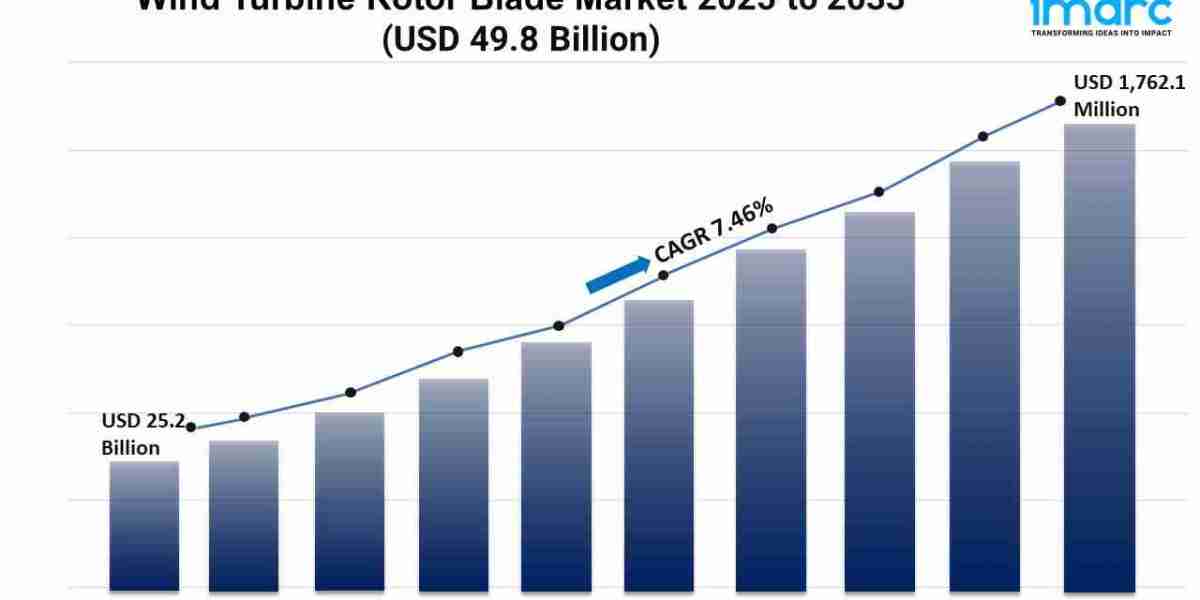

- The global wind turbine rotor blade market size reached USD 25.2 Billion in 2024.

- The market is expected to reach USD 49.8 Billion by 2033, exhibiting a growth rate (CAGR) of 7.46% during 2025-2033.

- Asia Pacific leads the market, accounting for the largest wind turbine rotor blade market share.

- Carbon fiber holds the majority of the market share in the blade material segment due to its lightweight properties that assist in reducing the load on turbine structures.

- 45-60 meters exhibit a clear dominance in the wind turbine rotor blade industry.

- Offshore remains a dominant segment in the market, allowing for the installation of larger turbines in the vast open sea areas.

- The rising demand of renewable energy is a primary driver of the wind turbine rotor blade market.

- Technological advancements are reshaping the wind turbine rotor blade market.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/wind-turbine-rotor-blade-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends And Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- Rising Demand for Longer Blades:

The wind turbine rotor blade market is seeing a surge in demand for longer blades, driven by the need for higher energy output and efficiency. Longer blades capture more wind, enabling turbines to generate more electricity even in low-wind regions. Manufacturers are investing in advanced materials like carbon fiber and lightweight composites to reduce weight while maintaining structural integrity. This trend aligns with the global push for renewable energy, as larger blades help reduce the Levelized Cost of Energy (LCOE), making wind power more competitive with fossil fuels.

- Growth in Offshore Wind Projects:

Offshore wind farms are expanding rapidly, creating strong demand for durable, high-performance rotor blades. Offshore turbines require larger, more robust blades to withstand harsh marine conditions while maximizing energy production. Governments and energy companies are heavily investing in offshore wind, particularly in Europe and Asia, accelerating blade innovation. This shift is prompting manufacturers to develop corrosion-resistant designs and modular blade solutions for easier transport and installation, further fueling market growth.

- Sustainability-Driven Material Innovation:

Sustainability is reshaping rotor blade production, with a focus on recyclable and eco-friendly materials. Traditional blades, made from fiberglass and epoxy resins, pose disposal challenges, leading to increased R&D in bio-based composites and thermoplastic resins. Companies are also exploring blade recycling methods to align with circular economy principles. As environmental regulations tighten and consumers demand greener energy solutions, the adoption of sustainable materials is becoming a key differentiator in the competitive wind turbine blade market.

Leading Companies Operating in the Global Wind Turbine Rotor Blade Industry:

- Acciona S.A.

- Enercon GmbH

- INOX Wind Limited

- LM Wind Power (General Electric Company)

- Moog Inc.

- Nordex SE

- SGS S.A.

- Siemens Gamesa Renewable Energy S.A. (Siemens Energy AG)

- Suzlon Energy Limited and Vestas Wind Systems A/S.

Wind Turbine Rotor Blade Market Report Segmentation:

Breakup By Blade Material:

- Carbon Fiber

- Glass Fiber

- Others

Carbon fiber accounts for the majority of shares as it offers superior strength-to-weight ratio and stiffness as compared to traditional materials like fiberglass.

Breakup By Blade Length:

- Below 45 Meters

- 45-60 Meters

- Above 60 Meters

45-60 meters dominate the market on account of their ability to offer a balance between energy capture efficiency and logistical feasibility.

Breakup By Location of Deployment:

- Onshore

- Offshore

Onshore represents the majority of shares due to its lower installation and maintenance costs.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific enjoys the leading position owing to a large market for wind turbine rotor blade driven by favorable government initiatives.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145