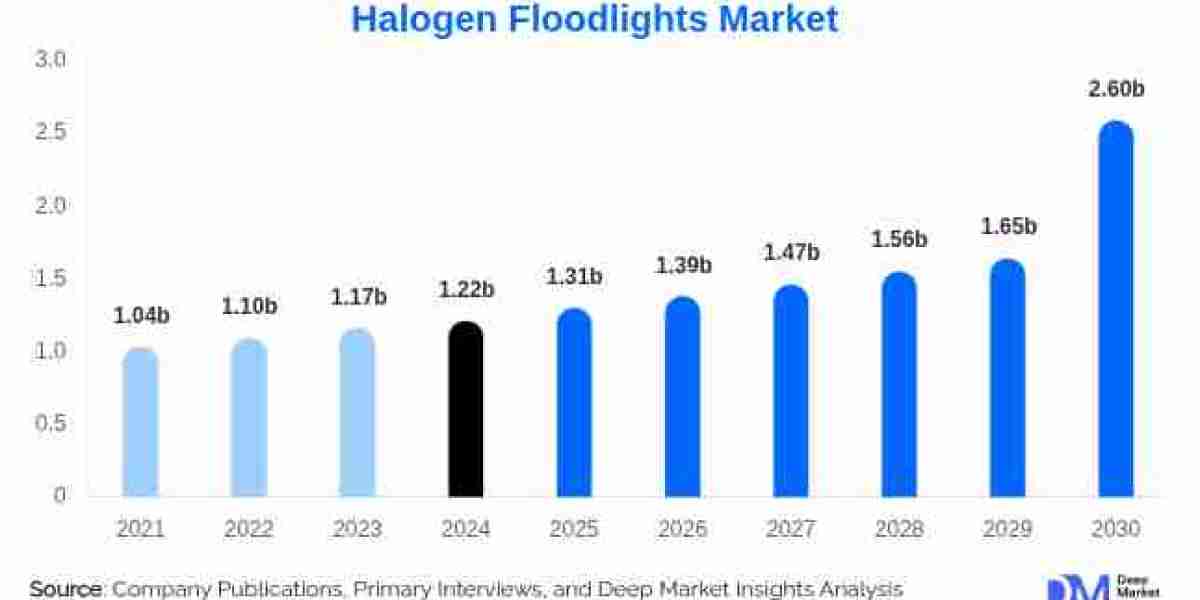

According to Deep Market, " The global halogen floodlights market was valued at USD 1.22 billion in 2024 and is projected to grow from USD 1.31 billion in 2025 to USD 2.6 billion by 2030, representing a CAGR of 6% over the forecast period (2025–2030)." Despite the increasing adoption of energy-efficient lighting, halogen floodlights continue to maintain relevance in cost-sensitive, industrial, and temporary lighting applications due to their affordability, high lumen output, and compatibility with legacy systems.

Market Segmentation and Key Drivers

The 150W–500W segment dominates the market, balancing affordability with sufficient brightness for medium- and large-scale applications. Halogen floodlights are extensively deployed across construction and industrial sites, government infrastructure, and municipal projects, where durability, instant full-brightness, and tolerance to voltage fluctuations are critical. Government and municipal bodies, especially in rural or budget-constrained regions, remain consistent consumers, sustaining demand despite the global push toward LED solutions.

Asia-Pacific holds the largest market share, driven by rapid infrastructure development and widespread use in developing countries such as India, Indonesia, and Vietnam. North America retains moderate market share, with halogen systems supported by legacy infrastructure and phased LED transitions, particularly in rural municipalities. Europe shows a declining trend due to stringent energy efficiency regulations but retains niche applications in theatres, stage lighting, and heritage building illumination where halogen’s brightness and color rendering remain preferred. The Middle East, Africa, and Latin America continue to rely on halogen floodlights in outdoor events, industrial sites, and budget-sensitive projects.

Technological Trends

The market is experiencing shifts influenced by energy efficiency and smart lighting trends. LED floodlights are increasingly preferred for their lower energy consumption, reduced carbon footprint, and longer lifespan. For instance, in March 2025, ACRHT installed solar-powered LED floodlights across 12 km² of NEOM City, Saudi Arabia, achieving 200 lux uniformity while replacing older metal halide systems, cutting energy use, and advancing zero-carbon goals.

Connected flood lighting systems based on IoT platforms are gaining traction. These systems allow remote control via smartphone apps, automated scheduling, motion and ambient light sensing, and real-time energy analytics. Over-the-air updates and cloud-based integration improve convenience, security, and system longevity. Smart lighting adoption aligns with broader digital transformations in urban infrastructure, commercial facilities, and residential developments.

Market Restraints

Despite steady demand, high initial costs of LED or IoT-enabled floodlights constrain adoption, particularly in emerging markets. Upfront investments for advanced fixtures, smart controls, and grid modifications can be two to three times higher than conventional halogen installations, creating extended payback periods. Technological obsolescence also poses a risk, as rapid advancements in high-performance LED, solar-powered, and connected lighting solutions reduce demand for halogen systems and limit parts and service support. Regulatory pressures further challenge manufacturers in compliance and market adaptation.

Opportunities and Niche Applications

The rise of smart cities presents opportunities for integrating floodlighting with urban infrastructure, including traffic management, surveillance systems, and energy monitoring. Solar-powered floodlights are increasingly relevant in areas with limited electrical access. Specialized applications in developed markets also support halogen growth, such as stage and studio lighting, heritage building accentuation, specialty agriculture, explosion-proof industrial zones, and aviation or automotive inspection facilities. These applications prioritize brightness, instant full-output, and color fidelity, where halogen remains advantageous.

Portable halogen floodlights are widely used for temporary installations such as construction sites, outdoor events, and emergency response, valued for quick deployment and intense illumination. The 150W–500W range remains popular in commercial and municipal projects, including street lighting, parking lots, and mid-sized event venues, maintaining relevance despite regulatory and efficiency pressures.

Competitive Landscape

Major players such as GE Lighting, OSRAM GmbH, NORDEX, STAHL, Rohrlux, RS Pro, and STEINEL continue to innovate in halogen floodlights. GE Lighting launched the “HalogenPro ToughSeries” in February 2025, designed for construction and mining environments with reinforced lenses and durable metal bodies. OSRAM’s March 2025 “VisualStar” series targets high CRI, studio-grade applications. STEINEL introduced its XLED Professional 5 floodlight with adaptive sensors, quick-swap modules, and smart connectivity in January 2025. These product launches highlight sustained investments in halogen-based solutions targeting specialized and cost-sensitive markets.

Conclusion

Halogen floodlights maintain a stable market position due to affordability, high brightness, and reliability in industrial, commercial, and temporary applications. While LED adoption and smart lighting integration redefine the broader market landscape, halogen systems continue to serve niche requirements, retrofit projects, and budget-constrained deployments. With Asia-Pacific leading growth and specific applications in developed regions, the market demonstrates resilience, balancing traditional performance needs with emerging technological trends.

About Us

Deep Market Insights is a leading market research organization, specializing in research, analytics, and advisory services along with providing business insights & market research reports

Contact Us:

Website: https://deepmarketinsights.com/