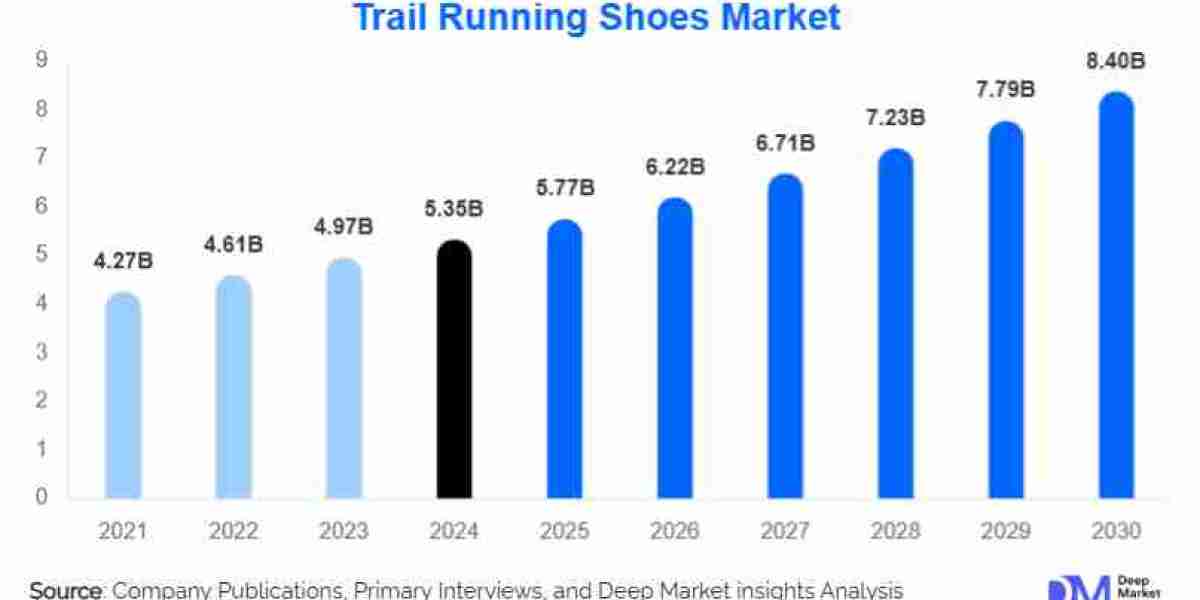

According to Deep Market Insights, " The global trail running shoes market was valued at USD 5.35 billion in 2024 and is projected to expand from USD 5.77 billion in 2025 to USD 8.4 billion by 2030. The market is expected to register a compound annual growth rate (CAGR) of 7.8% during the forecast period." Growth is supported by increasing trail race participation, the mainstreaming of outdoor fitness, and demand for footwear that combines grip, comfort, and protection on rugged terrain.

Market Overview

Trail running is evolving from a niche sport into a mainstream outdoor activity, attracting a broad consumer base worldwide. While North America and Europe currently dominate demand, Asia-Pacific is set to record the fastest growth through 2030. Waterproof and cushioned models remain in high demand in cold-weather regions, while interest in sustainable materials—such as vegan and recycled uppers—continues to expand. E-commerce has emerged as the leading sales channel, reinforced by strong direct-to-consumer strategies.

Market Size Forecast:

2024: USD 5.35 billion

2030: USD 8.4 billion

CAGR (2025–2030): 7.8%

North America: Largest market

Asia-Pacific: Fastest-growing market

Key Trends

Community-based trail events are driving demand for entry-level shoes by attracting new participants across age groups.

Customization through interchangeable insoles and modular designs is improving performance and consumer loyalty.

Cold-weather innovations such as spiked soles and insulated linings are expanding product applicability in sub-zero climates.

Urban-trail crossover models are gaining traction with city-based consumers seeking versatile footwear for mixed-terrain activities.

Subscription retail models are being piloted, offering recurring product updates and increasing brand-consumer engagement.

Market Drivers

Adventure and eco-tourism expansion is creating demand for durable shoes capable of handling varied terrains.

Integration into health and wellness routines ensures consistent demand from fitness-focused consumers.

Material and performance innovations, including energy-return midsoles and protective plates, are attracting wider adoption.

Athlete endorsements and sponsorships of ultramarathons and endurance events enhance brand credibility.

Rising outdoor participation in hiking and trekking supports both first-time and repeat purchases.

Market Restraints

Limited trail infrastructure in emerging regions restricts participation.

Heavy reliance on online channels limits accessibility for consumers requiring in-store fitting.

Counterfeit products erode consumer trust and brand value.

Technical complexity of features may discourage entry-level runners.

High price points limit adoption among price-sensitive consumers in developing markets.

Opportunities

Expanding youth participation provides long-term growth potential.

Military and tactical applications present specialized B2B sales channels.

Penetration into tier-2 and tier-3 cities in Asia-Pacific and Latin America offers untapped demand.

Collaborations with lifestyle brands broaden market appeal beyond core athletes.

Integration of wearable sensors and smart insoles creates scope for premium product differentiation.

Segmental Insights

By Type: Rugged shoes lead due to durability; lightweight models gain traction in short-distance races; cushioned shoes expand in ultra-distance events.

By End-User: Men currently account for the largest share, while women’s and unisex lines are expanding rapidly with tailored designs.

By Distribution Channel: E-commerce leads growth, but specialty outdoor stores and direct-to-consumer outlets remain vital in mature markets.

By Material: Synthetic and mesh remain dominant, with growing interest in vegan and bio-based alternatives.

Regional Insights

North America: Largest market, supported by extensive trail networks and mature retail channels.

Europe: Strong demand from alpine and mountain running communities in countries such as France, Italy, and Switzerland.

Asia-Pacific: Fastest-growing region, driven by expanding consumer bases in China, Japan, and India, alongside increasing trail tourism.

Latin America: Growth in Brazil, Chile, and Mexico supported by outdoor sports adoption.

Middle East & Africa: Emerging opportunities in South Africa and the UAE linked to adventure tourism.

Leading Companies

Key players include Salomon, Hoka, Nike Inc., Adidas AG, Brooks Running Company, La Sportiva, Altra Running (VF Corporation), New Balance, Mizuno, On Holding AG, Merrell (Wolverine World Wide Inc.), Scarpa, The North Face (VF Corporation), Columbia Sportswear Company, and Inov-8.

Recent Developments

March 2025: Salomon launched Ultra Glide 3 with improved cushioning for endurance runners.

April 2025: Hoka introduced Speedgoat 6, featuring lighter midsoles and sustainable materials.

May 2025: Adidas expanded its Terrex series in Asia, targeting humid and muddy trail conditions.

July 2025: Brooks Running released Catamount 3 with DNA Flash cushioning for mixed terrain.

Conclusion

The trail running shoes market is set for robust expansion over the next five years, fueled by rising participation in outdoor activities, sustained innovation in product design, and growth in emerging markets. With e-commerce and sustainability trends shaping consumer preferences, brands that combine performance, accessibility, and eco-conscious solutions are expected to capture significant market share through 2030.