Market Overview:

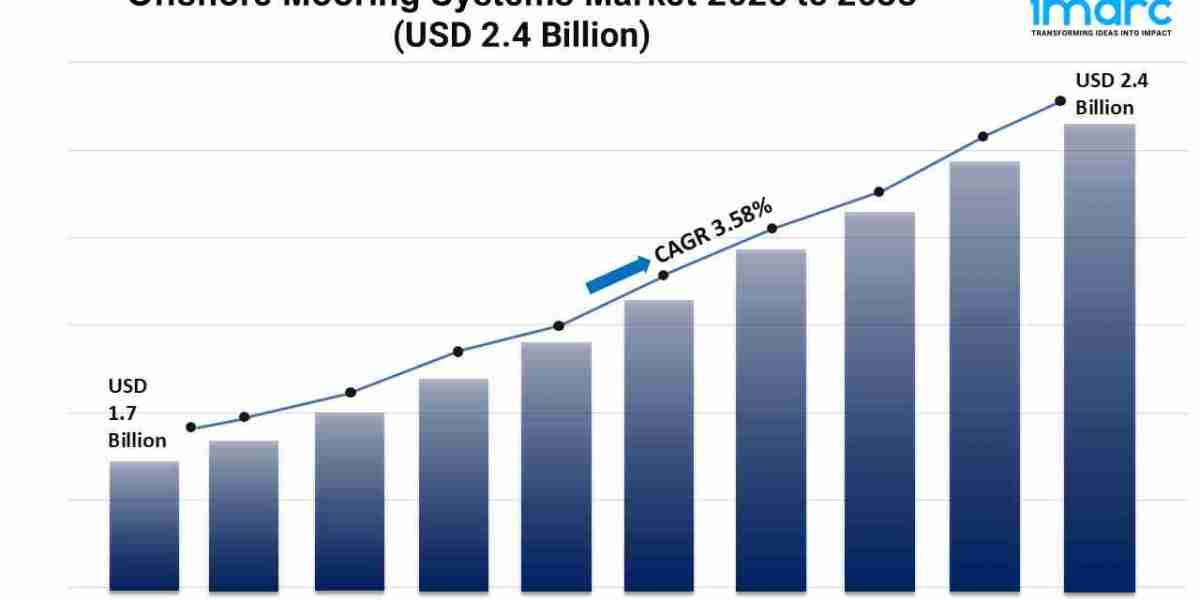

According to IMARC Group's latest research publication, "Offshore Mooring Systems Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global offshore mooring systems market size reached USD 1.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.4 Billion by 2033, exhibiting a growth rate (CAGR) of 3.58% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

How AI is Reshaping the Future of Offshore Mooring Systems Market

AI-driven predictive maintenance systems optimize offshore mooring performance by analyzing real-time sensor data, reducing downtime by 15% and extending equipment life by 20%.

Digital twin technology powered by AI enables 3D virtual modeling of mooring systems, allowing engineers to simulate stress patterns and optimize anchor placement with 95% accuracy.

Machine learning algorithms enhance weather forecasting accuracy for offshore operations, with AI-powered systems predicting extreme weather events 72 hours in advance, improving safety protocols.

Autonomous underwater vehicles (AUVs) equipped with AI conduct mooring inspections, reducing human risk and operational costs by 30% while increasing inspection frequency.

AI-enabled monitoring systems process over 10,000 data points per second from floating platforms, detecting potential mooring failures 48 hours before critical incidents occur.

Download a sample PDF of this report: https://www.imarcgroup.com/offshore-mooring-systems-market/requestsample

Key Trends in the Offshore Mooring Systems Market

Rising Deepwater Exploration Activities: Energy companies are venturing into ultra-deepwater locations exceeding 1,500 meters depth, driving demand for advanced spread mooring systems. The Asia-Pacific region leads with 35% market share, with countries like India and China increasing offshore exploration investments by 25% annually.

Growing Offshore Wind Energy Installations: The renewable energy sector is experiencing unprecedented growth, with offshore wind farms requiring sophisticated mooring solutions. Global offshore wind capacity reached 35 GW in 2024, with floating wind turbines needing specialized tension and mooring systems for deeper waters beyond 60 meters.

Technological Advancements in Mooring Materials: High-performance synthetic ropes and advanced anchor systems are replacing traditional steel chains, offering 60% weight reduction and improved fatigue resistance. Companies like SBM Offshore are investing $200 million in developing next-generation mooring technologies.

Expansion of FPSO Deployment: Floating Production Storage and Offloading (FPSO) units account for 42% of market applications, with 15 new FPSO projects announced in 2024. These vessels require complex spread mooring systems capable of handling harsh environmental conditions for 20+ years operational life.

Integration of Smart Monitoring Systems: Real-time monitoring solutions are becoming standard, with 78% of new installations incorporating IoT sensors for continuous mooring line tension monitoring. This trend reduces maintenance costs by 25% and prevents catastrophic failures through predictive analytics.

Growth Factors in the Offshore Mooring Systems Market

Increasing Energy Demand Globally: Rising global energy consumption drives offshore oil and gas exploration, with India's energy requirement increasing by 8.6% to 11,02,887 MU in fiscal 2023-24. This surge necessitates robust mooring systems for floating platforms in challenging deepwater environments.

Government Support for Offshore Exploration: National initiatives like Bangladesh's 2024 Offshore Bid Round offering 24 blocks (9 shallow-sea, 15 deep-sea) to international oil companies demonstrate government commitment to offshore development, boosting mooring system demand.

Technological Innovation in Mooring Solutions: Advanced vertical load anchors (VLAs) dominate the market with superior performance in deepwater applications. These systems handle significant vertical loads better than traditional drag anchors, making them essential for FPSO installations in water depths exceeding 2,000 meters.

Investment in Renewable Energy Infrastructure: The UK government's collaboration with Crown Estate could generate £60 billion private investment in offshore wind energy, creating substantial demand for specialized mooring systems designed for floating wind turbines.

Enhanced Safety and Environmental Standards: Stricter regulatory requirements for offshore operations drive adoption of advanced mooring technologies with improved reliability and environmental compliance, supporting market growth across all segments.

Leading Companies Operating in the Global Offshore Mooring Systems Industry:

- Balltec Ltd.

- Balmoral Comtec Ltd

- Bluewater Energy Services B.V. (Aurelia Energy N.V.)

- BW Offshore Limited

- Delmar Systems Inc

- Lamprell plc

- Mampaey Offshore Industries B.V

- MODEC Inc.

- NOV Inc.

- Offspring International Limited

- SBM Offshore N.V.

Offshore Mooring Systems Market Report Segmentation:

Breakup By Product Type:

- Spread Mooring

- Single Point Mooring

- Dynamic Positioning

- Tendons and Tension Mooring

- Others

Spread mooring accounts for the majority of shares due to its widespread use in deepwater oil and gas exploration and FPSO installations.

Breakup By Anchorage:

- Drag Embedment Anchors

- Suction Anchors

- Vertical Load Anchors

- Driven Pile

- Others

Vertical load anchors dominate the market owing to their superior performance in handling significant vertical loads in deepwater applications.

Breakup By Application:

- Tension Leg Platforms

- Semi-Submersible Platforms

- SPAR Platforms

- FPSO

- Drill Ships

- Others

FPSO holds the largest market share due to increasing deployment in deepwater oil and gas fields and their ability to operate independently of fixed infrastructure.

Breakup By Region:

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- North America (United States, Canada)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific enjoys the leading position owing to rising energy demand, increasing offshore exploration activities, and substantial investments in oil and gas projects across the region.

Recent News and Developments in Offshore Mooring Systems Market

March 2024: The Government of Bangladesh and Petrobangla launched the Bangladesh 2024 Offshore Bid Round, inviting international oil corporations to explore 24 blocks (9 shallow-sea and 15 deep-sea), driving demand for advanced mooring systems.

August 2024: The UK government announced a collaboration between Great British Energy and The Crown Estate that could generate £60 billion in private investment in offshore wind energy, significantly boosting floating wind turbine mooring requirements.

March 2023: ONGC and TotalEnergies signed a memorandum of understanding (MoU) to explore deepwater blocks in India, highlighting the growing focus on deepwater exploration in the Asia-Pacific region.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302