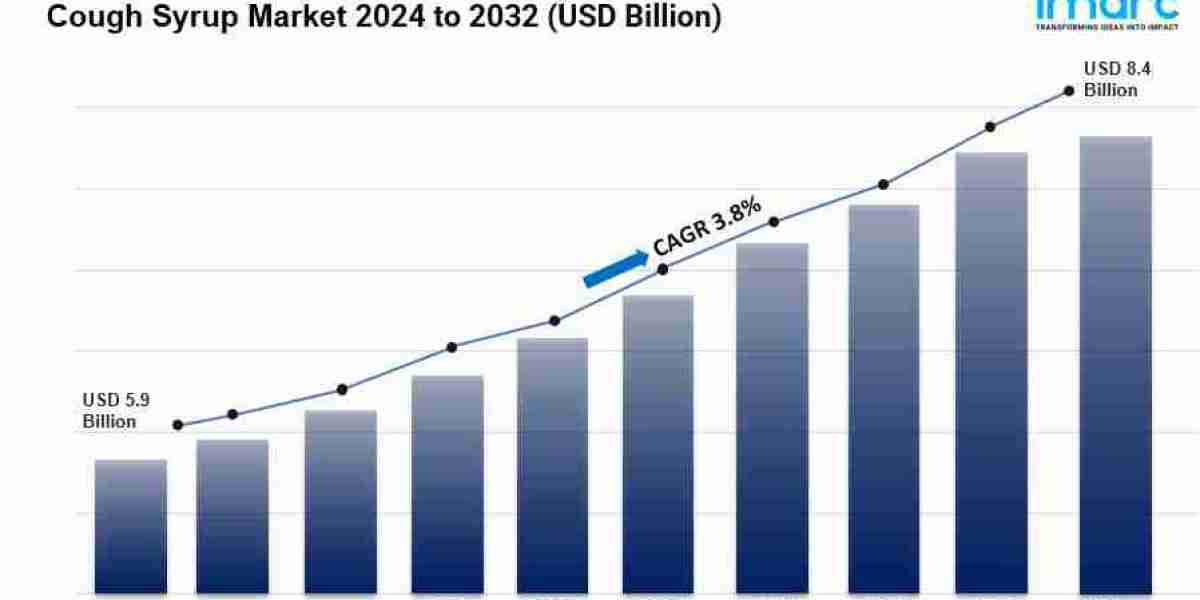

The global cough syrup market size reached USD 6.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.5 Billion by 2033, exhibiting a growth rate (CAGR) of 3.65% during 2025-2033. Asia Pacific currently dominates the market, driven by numerous partnerships among pharmaceutical companies and government organizations to develop novel generic drugs. The market is experiencing steady growth driven by the increasing occurrence of upper respiratory tract infections (URTIs) and other respiratory disorders, easy availability of cough syrups in general stores and pharmacies, and the rising prevalence of respiratory conditions due to unhealthy lifestyles and tobacco consumption. Moreover, detailed insights into Cough Syrup Market Share highlight the dominance of leading pharmaceutical companies, expansion of product portfolios, and rising penetration in emerging economies. Increasing awareness about over the counter (OTC) medications and continuous R&D efforts to develop sugar-free, alcohol-free, and herbal-based cough syrups are also reshaping the competitive landscape and influencing global Cough Syrup Market Share distribution.

Key Stats for Cough Syrup Market:

- Cough Syrup Market Value (2024): USD 6.1 Billion

- Cough Syrup Market Value (2033): USD 8.5 Billion

- Cough Syrup Market Forecast CAGR: 3.65%

- Leading Segment in Cough Syrup Market: Cough Suppressants/Antitussives (Majority market share)

- Key Regions in Cough Syrup Market: Asia Pacific, North America, Europe, Latin America, Middle East and Africa

- Top Companies in Cough Syrup Market: Acella Pharmaceuticals LLC, Bayer AG, GlaxoSmithKline PLC, Johnson & Johnson, Pfizer Inc., Prestige Consumer Healthcare Inc., Reckitt Benckiser Group PLC, Sanofi, Sun Pharmaceutical Industries Limited, The Procter & Gamble Company.

Request for a sample copy of this report: https://www.imarcgroup.com/cough-syrup-market/requestsample

Why is the Cough Syrup Market Growing?

The cough syrup market is experiencing steady growth as respiratory health issues become increasingly prevalent worldwide. What makes this growth particularly compelling is the intersection of lifestyle-driven health challenges and improved access to treatment options.

Respiratory conditions are on the rise globally, creating sustained demand for cough remedies. According to the World Health Organization, around 339 million individuals are affected by asthma worldwide, while the Economic Times reports significant increases in respiratory ailments across populations. The situation becomes more concerning when considering tobacco-related impacts – WHO data shows that more than 8 million people die prematurely from tobacco consumption annually, with 7 million direct smokers and 1.7 million second-hand smokers among the casualties.

The aging population adds another layer of complexity to market dynamics. WHO statistics indicate that individuals aged 60 and above numbered 1 billion in 2020 and are projected to reach 2.1 billion by 2050. This demographic shift naturally increases demand for respiratory care products, as older adults are more susceptible to chronic cough conditions and respiratory complications.

Government and healthcare organizations are taking proactive steps to address these challenges. The Lung Foundation in Australia launched a chronic cough awareness campaign in July 2023 to raise awareness and support diagnosis in both adults and pediatric populations. Such initiatives highlight the growing recognition of cough-related health issues and the need for effective treatment options.

Accessibility has improved dramatically across distribution channels. According to the Federal Union of German Associations of Pharmacists (ABDA), around 18,068 community pharmacies across Germany cater to medical needs, while retail pharmacy chains like Walmart and Walgreens continue expanding their generic and branded remedy product offerings.

AI Impact on the Cough Syrup Market:

Artificial intelligence is revolutionizing how we understand, diagnose, and treat cough-related conditions, creating new opportunities for the cough syrup market to deliver more targeted and effective solutions.

AI-powered cough detection and analysis systems are transforming respiratory healthcare. Companies like Hyfe AI have developed sophisticated algorithms that can distinguish cough sounds from other noises with up to 99% accuracy. Their AI-based cough detection engine monitors and analyzes cough patterns continuously, providing data-backed insights for healthcare providers and enabling more precise treatment decisions.

Diagnostic capabilities have reached remarkable sophistication levels. Salcit Technologies' Swaasa® product uses AI to analyze cough sounds and assess lung health, while Google's Health Acoustic Representations (HeAR) model is helping researchers detect diseases based on cough patterns. These technologies enable earlier intervention and more appropriate medication selection, potentially reducing the trial-and-error approach traditionally associated with cough treatment.

Smart monitoring applications are changing patient engagement with respiratory health. The AI4COVID-19 app demonstrated the potential of recording and analyzing cough sounds within 2 minutes, providing preliminary diagnostic insights. While cough can be a symptom of over thirty different medical conditions, AI helps differentiate between various causes, enabling more targeted treatment approaches.

Personalized medicine applications are emerging through AI analysis of individual cough patterns, duration, and intensity. Machine learning algorithms can predict treatment responses, optimize dosage recommendations, and identify patients who may benefit from specific cough syrup formulations. This precision approach improves treatment outcomes while reducing unnecessary medication usage.

The integration of AI with smartphone technology makes advanced cough analysis accessible to consumers worldwide. Apps like CoughTracker allow users to monitor their cough frequency and patterns, creating valuable data that can inform both personal health management and broader research initiatives into respiratory health trends.

Segmental Analysis:

Analysis by Product Type:

- Expectorants

- Cough Suppressants/Antitussives

- Combination Medications

Cough suppressants/antitussives account for the majority of the global market share due to their widespread use in managing cold and cough symptoms through over-the-counter medicines. Dextromethorphan, one of the most widely utilized cough suppressants in the U.S., has demonstrated superior effectiveness compared to traditional alternatives like codeine in clinical trials.

Analysis by Age Group:

- Pediatric

- Adult

Adult currently holds the largest market share as adults commonly suffer from chronic and acute cough due to unhealthy lifestyles and high exposure to tobacco. According to the European Respiratory Society, approximately 10% of the adult population suffers from chronic cough, significantly impacting quality of life.

Analysis by Distribution Channel:

- Retail Pharmacy

- Hospital Pharmacy

- Online Pharmacy

Retail pharmacy exhibits clear dominance in the market due to easy product availability, accessibility, and convenience. The rising number of generic and branded remedy products in retail pharmacy chains, along with increasing hospital partnerships, strengthens market growth.

Analysis of Cough Syrup Market by Regions

- Asia Pacific

- North America

- Europe

- Latin America

- Middle East and Africa

Asia Pacific exhibits clear dominance in the market, driven by numerous partnerships among pharmaceutical companies and government organizations to develop novel generic drugs. The region benefits from inflating expenditure capacities and elevated focus on preventive healthcare, with more than 55% of people becoming more conscious about boosting immunity since the COVID-19 pandemic according to FMCG Gurus.

Ask An Analyst: https://www.imarcgroup.com/request?type=report&id=3917&flag=C

What are the Drivers, Restraints, and Key Trends of the Cough Syrup Market?

Market Drivers:

The cough syrup market benefits from multiple interconnected growth factors that create sustained demand across diverse population segments. Rising prevalence of respiratory conditions including cold, flu, bronchitis, pertussis, asthma, COPD, and allergies drives consistent need for symptomatic relief.

Lifestyle factors significantly contribute to market expansion. Increasing tobacco consumption and unhealthy living patterns elevate cough cases across populations, while the expanding geriatric demographic naturally experiences higher rates of respiratory complications requiring pharmaceutical intervention.

Regulatory support strengthens market foundations through stringent quality standards. The Drugs Controller General of India (DCGI) has implemented detailed verification requirements for cough syrup manufacturers, ensuring global standard quality through joint verification drives on raw material suppliers and manufacturing processes.

Market Restraints:

Despite positive growth trends, the market faces several challenges that could impact expansion trajectory. Quality control concerns have emerged following WHO flagging of certain cough syrups for contamination, highlighting the critical importance of manufacturing standards and regulatory compliance.

Intense competition among generic and branded products creates pricing pressures that may affect profitability, particularly for smaller manufacturers lacking economies of scale. Additionally, growing awareness of potential side effects and drug interactions may lead some consumers to seek alternative treatment approaches.

Regional accessibility variations can limit market penetration in areas with limited pharmacy infrastructure or healthcare access, while regulatory differences across countries create compliance complexity for international manufacturers.

Market Key Trends:

Several transformative trends are reshaping the cough syrup landscape toward more natural and technologically advanced solutions. Companies are increasingly introducing cough syrups formulated with natural ingredients and herbs that offer immunity-boosting effects alongside symptomatic relief.

Merger and acquisition activities continue accelerating as major players seek to strengthen their clinical pipeline portfolios and market positions. GSK's 2023 acquisition of Bellus Health for US$ 2 billion demonstrates the strategic value placed on respiratory care capabilities and product portfolios.

Innovation in formulation technology is producing longer-lasting relief options. Sun Pharmaceutical Industries' Chericof 12 represents the first prescription cough syrup in India offering 12-hour relief, addressing consumer demand for convenient, extended-duration treatments.

Natural ingredient integration is gaining momentum with products like VITATUSS featuring elderberry, thyme, althaea, mallow, and sea buckthorn extract, catering to health-conscious consumers seeking plant-based alternatives to traditional synthetic formulations.

Leading Players of Cough Syrup Market:

According to IMARC Group's latest analysis, prominent companies shaping the global Cough Syrup landscape include:

- Acella Pharmaceuticals LLC

- Bayer AG

- GlaxoSmithKline PLC

- Johnson & Johnson

- Pfizer Inc.

- Prestige Consumer Healthcare Inc.

- Reckitt Benckiser Group PLC

- Sanofi

- Sun Pharmaceutical Industries Limited

- The Procter & Gamble Company

These leading providers are expanding their footprint through strategic partnerships, innovative product development, and acquisition strategies to meet growing consumer demands for effective respiratory symptom relief, natural ingredient formulations, and extended-duration treatment options across diverse demographic segments and distribution channels.

Key Developments in Cough Syrup Market:

- 2023 Strategic Acquisition: GSK plc signed a major acquisition deal with Canadian biotech firm Bellus Health for US$ 2 billion to strengthen its clinical pipeline portfolio and global market position, including syrup formulations for respiratory care applications, demonstrating significant industry consolidation trends.

- Regulatory Enhancement Initiative: The Drugs Controller General of India (DCGI) implemented comprehensive verification requirements for cough syrup manufacturers, mandating detailed quality checks on propylene glycol manufacturers and raw material suppliers to ensure global standard compliance and product safety.

- Innovation Launch: Sun Pharmaceutical Industries introduced Chericof 12, India's first prescription cough syrup offering 12-hour relief, representing breakthrough formulation technology that addresses consumer demand for convenient, extended-duration treatment options in respiratory care.

- Natural Product Development: Vitae Health Innovation launched VITATUSS, a natural syrup formulated with elderberry, thyme, althaea, mallow, and sea buckthorn extract, reflecting industry trends toward plant-based ingredients and immunity-boosting formulations that appeal to health-conscious consumers.

- Quality Assurance Advancement: The World Health Organization continues implementing stringent testing protocols after identifying contamination issues in specific batches, driving industry-wide improvements in manufacturing standards and quality control processes that benefit long-term market credibility and consumer safety.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302