IMARC Group, a leading market research company, has recently releases a report titled “Wine Packaging Market Size, Share, Trends and Forecast by Material Type, Packaging Type, and Region, 2025-2033.” The study provides a detailed analysis of the industry, including the global wine packaging market size, share, trends and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Wine Packaging Market Highlights:

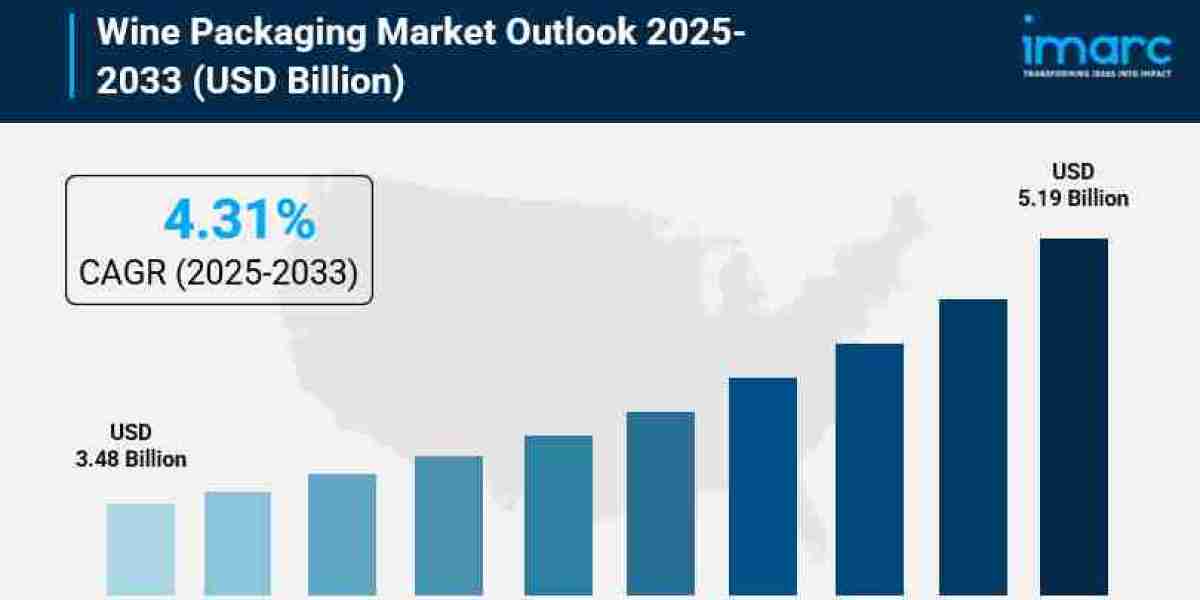

- Wine Packaging Market Size: Valued at USD 3.48 Billion in 2024.

- Wine Packaging Market Forecast: The market is expected to reach USD 5.19 billion by 2033, exhibiting a growth rate (CAGR) of 4.31% during 2025-2033.

- Market Growth: The wine packaging market is experiencing solid momentum as consumer preferences shift toward sustainable, innovative packaging solutions that balance environmental responsibility with aesthetic appeal.

- Sustainability Leadership: Eco-friendly materials like recycled PET, lightweight glass, and paper-based bottles are transforming the industry, with brands increasingly adopting packaging that reduces carbon footprints by up to 84%.

- Regional Dominance: Europe leads the market with 46.8% share, driven by its rich wine heritage, premium packaging demands, and strong consumer preference for sustainable solutions.

- Technology Integration: Smart packaging technologies including NFC tags and QR codes are revolutionizing consumer engagement, providing real-time product information and authenticity verification.

- Key Players: Industry leaders include Amcor Limited, Ardagh Group, Ball Corporation, Owens-Illinois Group, and Guala Closures, driving innovation with cutting-edge sustainable and premium packaging solutions.

- Market Challenges: Balancing cost-effectiveness with sustainability goals and meeting diverse regional preferences while maintaining wine quality during transit remain key challenges.

Request for a sample copy of the report: https://www.imarcgroup.com/wine-packaging-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- Sustainability Revolution Reshaping the Industry:

The wine packaging landscape is undergoing such a dramatic transformation given environmental consciousness is currently the focus. Consumers as well as producers alike demand packaging solutions with minimally impact ecology without compromising quality or aesthetics. Target made history in April 2025 launching America's initial national wine range in green paper bottles via The Collective Good brand. These revolutionary Frugal Bottles are launching in 1,200 stores plus they use 94% paperboard recycled while cutting carbon emissions by a huge 84%. This is not just about the usage of recycled materials it stands for environmental responsibility. Industry views on packaging design see a key basic change.

- Smart Packaging Technologies Transforming Consumer Engagement:

Digital innovators transform interactions for consumers and wine brands. These interactions also transform smart packaging solutions. NFC tags, QR codes, and digital labeling are allowing brand storytelling and consumer education new opportunities. These technologies provide instant access toward detailed product information including origin stories, tasting notes, vineyard practices, and food pairing suggestions. All of it becomes available from a tap on a smartphone. For combating of counterfeiting, Identiv, ZATAP, and Genuine-Analytics launched into an NFC-based smart packaging solution as designed specifically for luxury wines by way of a revolutionary partnership. The technology establishes a digital link between wine bottles with their contents because it uses IoT along with blockchain for verification. This matter targets a key issue where worries regarding genuineness have always troubled fine wine makers and buyers. Beyond just security, smart packaging enables brands to interact in real time with their customers, and this fosters loyalty and deeper relationships. Information that is vintage-specific is available for wine enthusiasts, and they can also track their collection. They can get personalized recommendations based on preferences too. Because consumers demand even more digital interaction, smart packaging transitions out from revolutionary differentiator into industry expectation.

- Premium Design and Customization Meeting Consumer Expectations:

Wine brands, in an increasingly crowded marketplace, leverage premium and custom-designed packaging to capture attention and create memorable brand experiences. Packaging is now viewed by consumers of today especially millennial and Gen Z wine drinkers as a part of the product experience not as just a vessel. Unique bottle shapes, artistic labels, with custom finishes are becoming necessary. Revolutionary closures have also been becoming important tools for differentiation. Aesthetics remain not the trend's only concern. Superior packaging emotionally links to buyers and indicates merit before buyers begin to uncap it. Detailed designs, reflecting terroir and appealing toward consumers' desire for exclusivity, tell wineries' brand story. This emphasis that is on visual appeal has importance particularly for wines that target to special occasions, or gifts, or retail environments. The packaging in and of itself became a part of the value proposition because these consumers are willing to pay the premium prices for wines if they present exceptionally along with quality content. Contributing as factors to improved consumer satisfaction are functional innovations like easy to open closures, resealable caps for bag-in-box formats, and protective packaging for e-commerce shipments.

- Global Wine Consumption Patterns Driving Packaging Innovation:

Across the globe, people consume wine in different new ways. These new habits do create demands for the packaging flexibility and format diversity. In 2023, the typical American consumed an average of 4.7 Liters of wine, also total national wine consumption reached 18.5 billion Liters in total. This substantial volume reflects upon how social norms around wine drinking change, for younger demographics embrace casual wine consumption and explore diverse varietals and formats. Demand is being driven by a need for convenient portable packaging options. This is because of the shift that is from formal wine drinking occasions to the everyday enjoyment of it. Aluminum cans as well as single-serve bottles also bag-in-box packaging happen to be alternative formats that are gaining meaningful traction. These formats draw particular interest from millennials who prioritize convenience and sustainability. In markets emerging such as India, the annual consumption of wine approximates 400,000 cases. Packaging crucially establishes brands and educates consumers in which table wines comprise 85% and premium varieties comprise the rest. Domestic producers and international brands increasingly emerge and promote investment in special packaging solutions made for local tastes. Packaging requirements are being influenced also by trade dynamics. Wine shipments to Latin America rose 7.7% during 2024 reaching USD 1.1 Billion. Because cross-border wine trade grows, packaging must meet diverse regulatory requirements, must protect products during transit, also must appeal to varied cultural aesthetics.

Wine Packaging Market Report Segmentation:

Breakup by Material Type:

- Glass

- Plastic

- Metal

- Paper Board

- Others

Breakup by Packaging Type:

- Bottles

- Bag-in-Box

- Aseptic Cartons

- Bulk Packaging (IBCs, Flexitanks and Drums)

- Others

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Who are the key players operating in the industry?

The report covers the major market players including:

- Amcor Limited

- Ardagh Group

- Ball Corporation

- Encore Glass

- G3 Enterprises

- Guala Closures

- International Paper

- Maverick Enterprises Inc. (Sparflex SA)

- Owens-Illinois Group

- Scholle Ipn Corporation

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=3117&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302