IMARC Group, a leading market research company, has recently releases a report titled “Industrial Salts Market Report by Source (Brine, Salt Mines), Product (Rock Salt, Salt in Brine, Solar Salt, Vacuum Pan Salt), Application (Chemical Processing, De-Icing, Oil and Gas, Water Treatment, Agriculture, and Others), and Region 2025-2033.” The study provides a detailed analysis of the industry, including the global industrial salts market size, share, trends and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Industrial Salts Market Highlights:

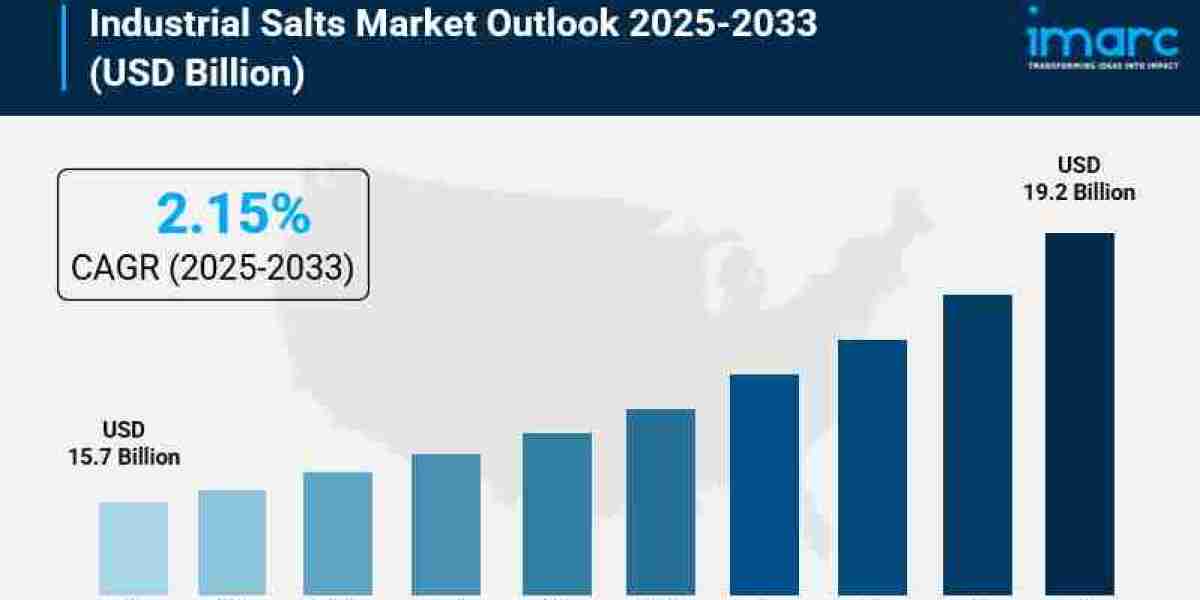

- Industrial Salts Market Size: Valued at USD 15.7 Billion in 2024.

- Industrial Salts Market Forecast: The market is expected to reach USD 19.2 Billion by 2033, growing at a steady rate annually.

- Market Growth: The industrial salts market is experiencing consistent expansion driven by increasing demand across water treatment facilities, chemical processing plants, and de-icing operations worldwide.

- Water Treatment Dominance: Municipal and industrial water treatment applications are emerging as the fastest-growing segment, with industrial salts playing a crucial role in water softening and wastewater purification processes.

- Regional Leadership: Asia Pacific leads the global market, driven by rapid industrialization in China and India, along with massive infrastructure development projects requiring significant salt consumption.

- Chemical Processing Strength: The chemical processing segment continues to dominate applications, accounting for the largest share as industries ramp up production of caustic soda, soda ash, and chlorine for manufacturing.

- Key Players: Industry leaders include Compass Minerals International Inc., Cargill Inc., Tata Chemicals Limited, K+S AG, and Akzo Nobel N.V., which drive innovation and supply chain efficiency.

- Market Challenges: Environmental concerns around salt mining, seasonal demand fluctuations for de-icing applications, and the need for sustainable extraction methods present ongoing challenges.

Request for a sample copy of the report: https://www.imarcgroup.com/industrial-salts-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- Explosive Growth in Water Treatment Infrastructure:

The global push for clean water access creates industrial salts' extraordinary need. Water treatment facilities rely quite heavily on sodium chloride in softening processes that remove calcium as well as magnesium ions. These processes prevent scale buildup in pipes also industrial equipment. For municipal wastewater treatment, plants use industrial salts supporting processes that coagulate and flocculate, important for removing pollutants before water is discharged or reused. Since the world population is over 8 billion and urbanization goes on fast across nations developing, cities spend billions to improve water infrastructure. More stricter environmental regulations are now forcing industries to treat all of their effluents in a more thorough way and this also creates sustained demand for water treatment chemicals. According to estimates by the United Nations, over 2 billion people still lack access to safely managed drinking water services. Governments now focus on important water projects so industrial salts become quite important there.

- Booming Chemical Manufacturing Sector:

Important chemicals modern industries need originate from industrial salts forming their base. By the chlor-alkali process, caustic soda, soda ash, and chlorine are produced which uses salt as its primary raw material chemicals critical to manufacturing paper, glass, textiles, pharmaceuticals, and plastics. The paper as well as pulp industry alone consumes massive quantities of the industrial salts. They bleach, wash, and neutralize with these salts. Global PVC production keeps growing with chlorine derived from salt as construction increases across emerging economies. GHCL did announce such an investment of USD 40.44 million in December of 2024. GHCL makes much salt as a major manufacturer inside the Dalmia Group of India so the investment will build a new salt field within Kutch, Gujarat to show confidence of manufacturers in chemical industry demand long-term. Applications for chemical processing show strong growth relying on consistent high-purity industrial salt supplies. This growth imitates such a route.

- Oil and Gas Industry Driving Specialized Demand:

Industrial salts are used in the oil as well as gas sector's most technically demanding applications. Sodium chloride with potassium chloride, in drilling, make fluids function to keep proper fluid density, control downhole pressure, and stabilize boreholes. These salts prevent swelling of shale formations when water-based drilling fluids get used thereby preventing operational complications and also expensive delays. For improved oil recovery, techniques can help extract additional petroleum from aging wells since they precisely formulate salt solutions which modify fluid salinity plus improve oil displacement efficiency. For energy companies, larger volumes of specialized industrial salts are a requirement as they explore unconventional shale plays and deepwater offshore sites, which are increasingly challenging geological formations. The energy transition goes on but there is oil and gas exploration still. Companies focus on maximizing efficiency within existing fields, which drives steady demand for salt-based drilling and recovery solutions.

- Winter Road Safety and Infrastructure Maintenance:

Regions undergoing harsh winter conditions see substantial volumes of rock salt consumed annually. De-icing operations cause this consumption. For keeping transportation infrastructure both operational and quite safe during both snow and ice events, sodium chloride is depended upon by railway operators and airport authorities and road maintenance departments. Rock salt is the de-icing agent that is of choice because it is effective. Most municipalities and transportation agencies choose it also because it is quite affordable. American Rock Salt reported shipping that was over 2.1 million tons through January only in early 2025, and that is compared to 1.8 million tons for what was the entire previous winter season. Severe weather patterns are driving increased consumption, according to that shows. In cities, larger salt reserves are being stockpiled as unpredictable extreme winter weather events increase via climate change. Compass Minerals, which is a leading North American salt producer, refocused its strategy during 2024 so that it could concentrate on its core salt business because it recognized the consistent demand which comes from de-icing applications. Disciplined pricing for the company proved successful since its early strategy in bidding on winter contracts secured margins and volumes that were stable.

- Sustainable Agriculture and Soil Management:

Farmers are applying industrial salts within agriculture, seeking improvements to soil fertility and seeking to manage salinity issues that reduce crop yields. For animal health in livestock farming and for productivity, salt blocks and mineral supplements are a necessity when they contain salts that are industrial-grade. Throughout the agricultural supply chain, salt is used within food preservation along with processing. The Atlas Salt company entered a planned partnership with Scotwood Industries in February 2024 because they intended to distribute 1.25 to 1.5 million tonnes of salt products annually across the Canadian market, with meaningful portions directed toward agricultural applications. This partnership underscores the growing recognition of industrial salts for the sake of modern farming. Global food demand continues to rise up, agricultural productivity is increasingly important for food security now, so the agricultural segment can grow up, particularly as regions develop farming infrastructure for and adopt advanced agricultural practices now.

Industrial Salts Market Report Segmentation:

Breakup by Source:

- Brine

- Salt Mines

Brine dominates the source segment, extracted through solution mining where water dissolves underground salt deposits, yielding high-purity salts ideal for chemical processing and water treatment applications.

Breakup by Product:

- Rock Salt

- Salt in Brine

- Solar Salt

- Vacuum Pan Salt

Solar salt captures the largest product share, produced through natural evaporation of seawater or brine in shallow ponds, offering an eco-friendly production method with minimal energy requirements and consistent quality.

Breakup by Application:

- Chemical Processing (Caustic Soda, Soda Ash, Chlorine)

- De-Icing

- Oil and Gas

- Water Treatment

- Agriculture

- Others

Chemical processing accounts for the dominant application segment, with industrial salts serving as the primary feedstock for producing caustic soda, soda ash, and chlorine—essential chemicals for manufacturing across multiple industries.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Who are the key players operating in the industry?

The report covers the major market players including:

- Akzo Nobel N.V.

- Cargill Inc.

- Compass Minerals International Inc.

- Dominion Salt Limited

- Donald Brown Group

- INEOS Group Ltd.

- K+S AG

- Mitsui & Co. Ltd.

- Nouryon Chemicals B.V.

- Rio Tinto PLC

- Tata Chemicals Limited

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=4487&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302