Yes, you can consolidate your federal scholar loans through a Direct Consolidation Loan, which simplifies funds by combining them into one.

Yes, you can consolidate your federal scholar loans through a Direct Consolidation Loan, which simplifies funds by combining them into one. However, consolidating private loans might require refinancing and could lead to a loss of federal advanta

n Before taking out a small loan, consider the entire cost, together with curiosity and fees, and guarantee your finances can accommodate the repayments. Read the mortgage settlement carefully to understand all phrases and circumstances. Assessing your financial situation truthfully will help you keep away from potential pitfalls associated with borrow

Most lenders will examine the applicant’s credit history to gauge repaying capacity. A larger credit score score usually enhances the chances of securing the loan with higher terms. In distinction, a low rating may limit options or result in larger interest ra

Be픽: Your Resource for Understanding Delinquent Loans

Be픽 is a useful on-line useful resource devoted to offering complete information on *delinquent loans*. The web site presents insightful reviews, detailed articles, and expert recommendation to help both lenders and borrowers navigate the complexities of

Daily Loan delinque

Eligibility Criteria for Unemployed Loans

While unemployed loans tend to have fewer eligibility requirements, certain criteria remain consistent across lenders. Most generally, people must be at least 18 years old, possess legitimate identification, and supply some form of contact information. Because income verification may not be strictly essential, lenders often assess the applicant's credit score history to determine threat eleme

Maintaining good credit is therefore important. Students should purpose to build their credit scores by paying bills on time, keeping bank card balances low, and avoiding unnecessary debt. Doing so not solely helps in securing scholar loans but additionally units a strong monetary foundation for future borrow

Through 베픽, customers can entry guides on tips on how to apply for loans, understand the various reimbursement options available, and get recommendations on managing their loans effectively after commencement. The web site additionally supplies comparisons of personal lenders, allowing college students to make informed decisions based on their particular person ne

Upon approval, the borrower should perceive the mortgage terms, together with reimbursement schedules and any related charges. Clear communication with the lender is significant to avoid misunderstandings or added costs later within the compensation t

To improve your credit score score after experiencing delinquency, give attention to making all future funds on time. Additionally, attempt to cut back your credit card balances and keep away from taking up new debt. Regularly examine your credit score report for inaccuracies and dispute any errors. Over time, positive payment behavior will help rehabilitate your credit score sc

The Benefits of Unemployed Loans

One of the primary advantages of unemployed loans is the **quick entry to funds**. Time is often of the essence when coping with instant monetary obligations, and these loans can present quick approvals and funding. This enables these fighting financial difficulties to cover pressing bills with out long del

Additionally, people ought to explore all obtainable sources to assist during unemployment before opting for loans. Sometimes, authorities assistance or neighborhood applications might provide

Additional Loan help with out the necessity for d

Personal loans from banks or credit unions symbolize another avenue. These loans might supply decrease interest rates and higher phrases, particularly for those with good credit score scores. Additionally, some could choose to discover borrowing from pals or household, which can generally present interest-free loans if both parties ag

Types of Loans Prone to Delinquency

Various types of loans are prone to delinquency, including private loans, bank cards, and scholar loans. *Credit cards*, specifically, current a high risk as a result of their revolving nature. Borrowers typically accumulate debt quickly, leading to overwhelming funds when they miss deadli

Additionally, individuals with poor credit score scores could view 24-hour loans as a lifeline. Traditional lenders usually impose strict credit necessities, making it difficult for those with less-than-perfect credit to secure funds. Many online lenders providing 24-hour loans contemplate alternative approval standards, rising entry to financing for a broader audie

Evaluating your financial needs can be crucial. Understand how much cash you have to borrow and for what purpose. This clarity helps in avoiding pointless borrowing, which may result in difficulty in compensation. Additionally, establish a repayment plan for the loan to ensure you can meet your obligations with out further financial str

The Evolution of Interactive Toys: From Mechanical Dolls to Pets Alive Mama Duck

The Evolution of Interactive Toys: From Mechanical Dolls to Pets Alive Mama Duck

The particular Go up regarding Direct Win Prediction A fresh Time inside Gambling and also Gambling

United States Pain Management Therapeutics Market Size And Forecast Report 2024-2032

United States Pain Management Therapeutics Market Size And Forecast Report 2024-2032

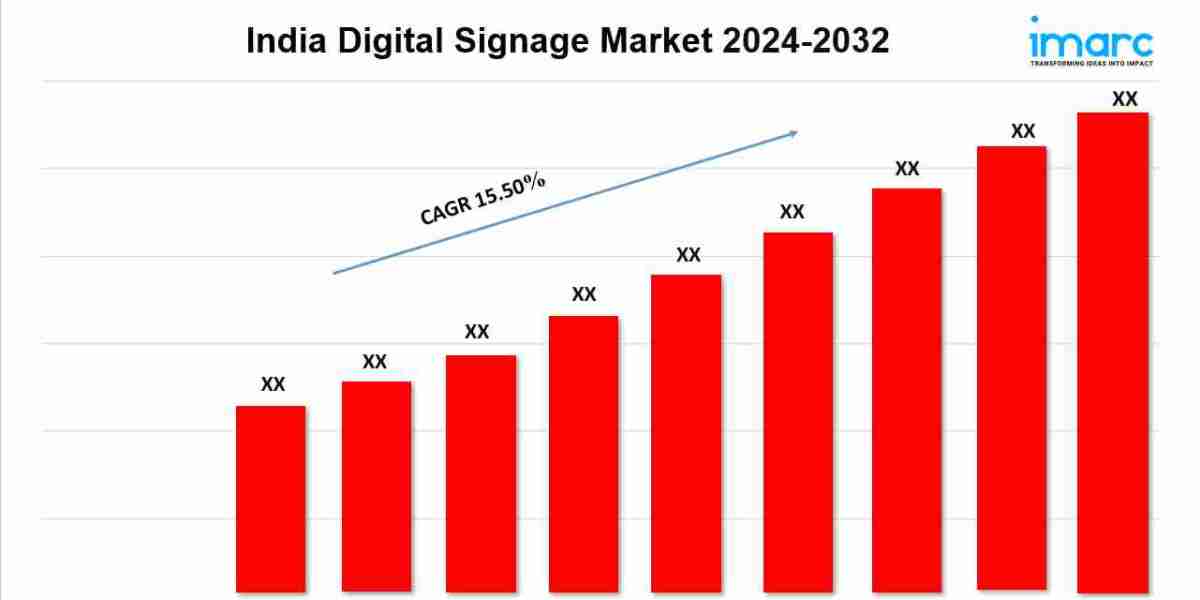

The Rise of Digital Signage: A Modern Approach to Communication and Advertising

By devidstarc Fitness Keto Capsules Price: Cost, Uses, Functions, and Global Pricing New Zealand & Australia

Fitness Keto Capsules Price: Cost, Uses, Functions, and Global Pricing New Zealand & Australia