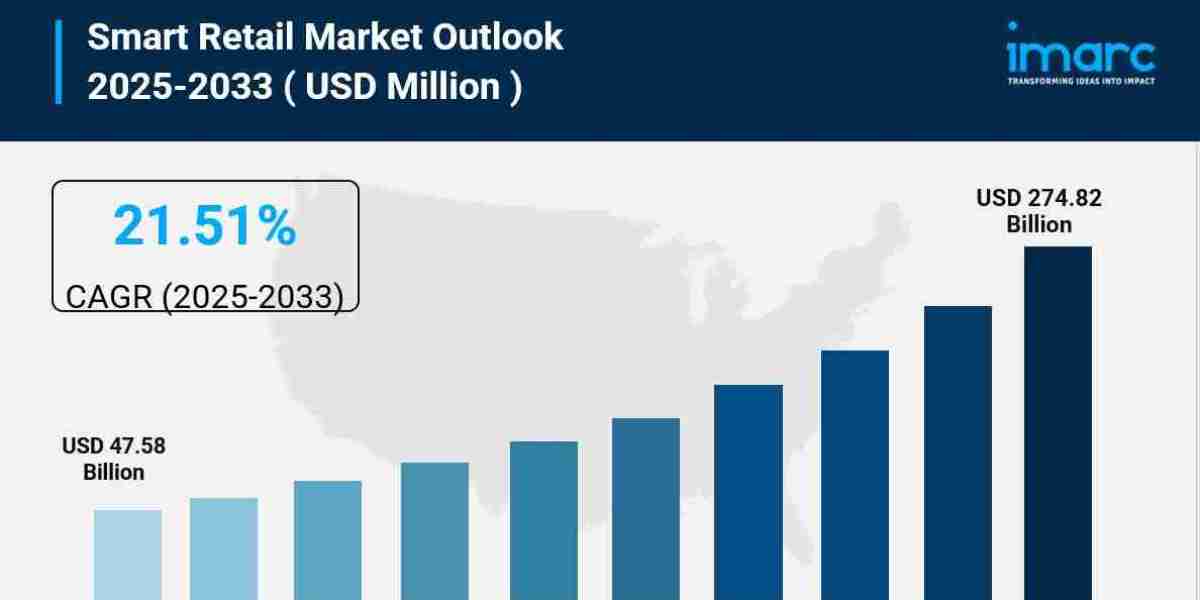

The global smart retail market size was valued at USD 47.58 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 274.82 Billion by 2033, exhibiting a CAGR of 21.51% during 2025-2033. North America currently dominates the market, holding a significant market share of over 34.7% in 2024. The market is experiencing steady growth driven by innovations in technology, changing user expectations, rising automation trends, and the increased product adoption due to personalization, convenience, and seamless shopping experiences.

Key Stats for Smart Retail Market:

- Smart Retail Market Value (2024): USD 47.58 Billion

- Smart Retail Market Value (2033): USD 274.82 Billion

- Smart Retail Market Forecast CAGR: 21.51%

- Leading Segment in Smart Retail Market in 2024: Hardware (66.2%)

- Key Regions in Smart Retail Market: North America, Asia Pacific, Europe, Latin America, Middle East and Africa

- Top Companies in Smart Retail Market: Adroit Worldwide Media Inc., Amazon.com Inc., Cisco Systems Inc., Google LLC (Alphabet Inc.), Honeywell International Inc., Ingenico, Intel Corporation, NCR Corporation, NVIDIA Corporation, NXP semiconductors N.V., PTC, Samsung Electronics Co. Ltd., Zippin, etc.

Why is the Smart Retail Market Growing?

The smart retail market is experiencing rapid expansion as retailers respond to evolving consumer demands for faster, more personalized shopping experiences. At its core, this transformation is about meeting people where they are—whether that's in a physical store or browsing on a mobile device at midnight.

Today's shoppers expect stores to know what they want before they even ask. They want to walk in, grab what they need, and leave without waiting in checkout lines. This isn't science fiction anymore—it's happening in stores across the globe. Retailers are deploying smart shelves that automatically track inventory levels, digital price tags that update instantly across thousands of products, and checkout-free systems that let customers simply walk out with their purchases.

The numbers tell a compelling story about where retail is headed. Industry surveys reveal that 71% of shoppers now expect brands to understand their purchasing behaviors, while 77% are more likely to make a purchase when they receive relevant product recommendations. Among younger shoppers, particularly Millennials, that figure jumps to 83%. Perhaps most striking is that 90% of consumers want more personalized communication from the brands they shop with.

Behind the scenes, retailers are responding to these expectations by implementing technologies that were once considered futuristic. AI-powered systems analyze customer data from multiple touchpoints—previous purchases, browsing history, in-store movements—to create shopping experiences that feel tailor-made for each individual. Smart mirrors in fitting rooms suggest complementary items. Mobile apps guide shoppers to exactly what they're looking for. Digital displays adjust their messaging based on who's walking past.

The automation wave sweeping through retail isn't just about improving customer experience—it's also addressing very real operational challenges. Labor shortages have pushed many retailers toward robotic solutions for restocking shelves and monitoring inventory. Automated systems ensure products are always available when customers want them, reducing the frustration of finding empty shelves.

Request Sample URL: https://www.imarcgroup.com/smart-retail-market/requestsample

AI Impact on the Smart Retail Market:

Artificial intelligence is fundamentally changing how retail works, moving it from reactive to predictive operations. The technology has matured beyond experimental phases into practical applications that directly impact both customer satisfaction and business performance.

According to Stanford's AI Index, 78% of organizations reported using AI in 2024, up from 55% the previous year. This rapid adoption reflects AI's proven ability to solve real retail challenges. The technology excels at processing massive amounts of data—something that's become essential as retailers track customer interactions across dozens of touchpoints.

In practical terms, AI is reshaping inventory management in ways that seemed impossible just a few years ago. McKinsey research shows that AI-powered demand forecasting can reduce supply chain errors by 20-50% while cutting lost sales by up to 65%. These aren't marginal improvements—they represent millions of dollars in recovered revenue for major retailers. The system learns from historical data, weather patterns, local events, and countless other variables to predict what products will be needed where and when.

Segmental Analysis:

Analysis by Offering:

Hardware

- RFID tags and labels

- Scanner/readers

- Mobile computers

- Point of sale (POS) terminals

- Others

Software

Services

Hardware led the market in 2024 with a 66.2% share, forming the physical backbone of smart retail solutions. These devices—from RFID scanners to modern POS terminals—are essential for implementing automation and real-time data tracking in stores. Retailers are investing heavily in hardware to support mobile payments, automated checkout, and security systems as demand grows for seamless, contactless services. The integration of AI and IoT with these physical components is amplifying their capabilities, enabling smart analytics and responsive in-store experiences that adapt to customer behavior in real time.

Analysis by Retailer Size:

Small and Mid-sized Retailers

Large Retailers

Small and mid-sized retailers are embracing smart retail tools to level the playing field against larger competitors. They're focusing on cost-effective solutions like digital signage and cloud-based inventory management that deliver impact without requiring massive infrastructure investments. These retailers often use their agility as an advantage, implementing personalized service strategies enabled by smart technologies that help them compete on customer experience rather than scale.

Large retailers dominate significant market share due to their greater financial resources and established infrastructure. They're implementing comprehensive solutions including robotics, big data analytics, and omnichannel platforms that deliver personalized shopping experiences at massive scale. Their wide customer base and global presence create both the need and the opportunity for continuous innovation in smart retail technologies.

Analysis by Application:

Visual Marketing

Smart Label

Smart Payment System

Intelligent System

Others

Visual marketing accounts for 29.6% of the market share, playing a crucial role in capturing customer attention and influencing purchase decisions. Retailers use digital displays, interactive screens, augmented reality, and smart signage to create engaging, immersive shopping experiences. These tools showcase product features, promotions, and personalized offers in real time, making marketing more dynamic and effective than traditional static displays. Visual content processes faster and sticks in memory longer, helping brands stand out in crowded retail environments while supporting storytelling that builds emotional connections and loyalty.

Analysis by End User:

Supermarkets

Hypermarkets

Specialty Stores

Department Stores

Others

Supermarkets are adopting smart retail solutions to manage fast-moving consumer goods efficiently. They use automated checkout systems, real-time inventory tracking, and digital price tags to speed up operations and reduce errors. Smart shelves and mobile apps track stock levels and guide customers through the store, while data analytics helps create personalized promotions.

Hypermarkets implement smart retail technologies to handle their large-scale operations and vast product variety. They use robotics, AI, and IoT for automated inventory management, smart checkout, and real-time data insights. Digital signage and targeted promotions enhance in-store marketing, while customer flow analysis tools and heat maps optimize store layouts.

Specialty stores leverage smart retail solutions to offer highly personalized shopping experiences. They implement AR displays, AI-based recommendation engines, and smart fitting rooms to engage customers and highlight what makes their products unique. Digital signage and loyalty programs based on customer data improve brand interaction.

Department stores manage multiple product categories under one roof using AI-powered analytics, interactive kiosks, and smart mirrors to assist customers. Real-time stock management ensures product availability and reduces shrinkage, while data-driven personalized promotions work across departments to encourage cross-selling and boost satisfaction.

Analysis of Smart Retail Market by Regions

North America

Asia Pacific

Europe

Latin America

Middle East and Africa

North America led the market with a 34.7% share, driven by strong technological infrastructure, high digital adoption, and the presence of major retail and tech companies. The region benefits from sophisticated digital shopping habits, with consumers embracing mobile payments and self-checkout systems at higher rates than most other regions. Within North America, the United States holds 88.40% of the market share, propelled by the rapid adoption of contactless shopping technologies and the deployment of IoT inventory systems.

The transformation happening in North American retail is tangible. By late 2024, the US and Canada exceeded 182 Million 5G connections, with growth approaching 20% annually. By early 2025, US 5G standalone networks achieved median download speeds of 388.44 Mbps, surpassing speeds in Japan and China. This infrastructure supports the real-time data transmission that smart retail applications require, from instant inventory updates to seamless mobile checkout experiences.

The United States AI market reached USD 37,029.9 Million in 2024, and North America's big data analytics market hit USD 113.4 Billion the same year. These investments in foundational technologies are directly enabling smart retail innovations. Retailers have the digital infrastructure and consumer readiness to implement cutting-edge solutions that might not yet be viable in other regions.

Europe's smart retail market is growing through robust digital transformation programs backed by national and EU-level funding initiatives. The region shows particularly strong adoption of electronic shelf labels, which improve pricing precision and reduce manual labor costs for large retail chains. Cashier-less stores and frictionless checkout models are transforming convenience retail across major European cities. Sustainability awareness drives smart energy use and circular practices, while rapid urbanization and expanding smart city projects lead to investments in connected retail ecosystems. In 2023, almost 50% of German shoppers used digital wallets for online purchases, and 33% used them for bill payments, showing the growing acceptance of digital payment methods.

The Asia-Pacific market is driven by rapid urbanization and a growing base of tech-savvy middle-class consumers seeking advanced shopping experiences. As of June 2025, China led worldwide in smartphone users with 974.69 Million users and a penetration rate of 68.4%—nearly 1.5 times greater than any other nation. Strong government initiatives to develop digital infrastructure support investments in connected retail technologies. The region's competitive e-commerce landscape motivates traditional retailers to adopt smart solutions to maintain market share, while AI-powered chatbots and virtual assistants improve customer engagement and operational efficiency.

Latin America's market is expanding through the rising adoption of digital payment solutions that streamline traditional checkout processes and enhance transaction efficiency. The Brazilian Central Bank reported that digital transactions represented over 80% of all banking operations in 2023, a significant increase from 54% in 2014. Smartphone usage drives mobile commerce and contactless payments, while retailers invest in smart logistics and automated warehousing systems to strengthen inventory management. Expanding internet connectivity across urban and rural regions supports omnichannel retail strategies that bridge online and offline experiences.

The Middle East and Africa market is influenced by widespread mobile payment and digital wallet adoption, reshaping both in-store and online shopping experiences. Rising demand for sophisticated security and surveillance systems promotes the integration of AI-based monitoring and analytics. The region is experiencing a surge in digital transformation, exemplified by BirdEye, a Saudi Arabia-based startup that raised USD 586,000 in a pre-seed round in late 2024. The platform assists small and medium-sized enterprises in managing their activities and staying competitive in an increasingly digital landscape.

Request Customization: https://www.imarcgroup.com/request?type=report&id=8058&flag=E

What are the Drivers, Restraints, and Key Trends of the Smart Retail Market?

Market Drivers:

The smart retail market is propelled by several interconnected forces reshaping how people shop and how retailers operate.

Smartphone and wearable adoption continues to accelerate globally, creating a foundation for smart retail experiences. These devices serve as gateways to personalized shopping, enabling everything from mobile payments to location-based promotions. Consumers carry powerful computers in their pockets, and retailers are building experiences around that reality.

Health awareness and lifestyle changes are driving demand for more convenient shopping options. Busy professionals working hybrid schedules want to shop on their terms—whether that's a quick mobile order during a meeting or a late-night browsing session from the couch. The popularity of home delivery and curbside pickup reflects these changing priorities.

Personalization has evolved from a nice-to-have feature to a fundamental expectation. Shoppers now expect stores to remember their preferences, anticipate their needs, and make relevant recommendations. Smart retail technologies make this level of personalization scalable, allowing retailers to treat millions of customers as individuals rather than demographics.

The younger demographic's preference for digital solutions continues to shift market dynamics. Generation Z and Millennials grew up with smartphones and expect seamless digital experiences in every aspect of life, including shopping. They're comfortable with new technologies and quick to adopt innovations that make their lives easier.

Subscription-based models are changing retail economics. Monthly memberships for everything from meal kits to fashion rentals create predictable revenue streams while building customer loyalty. Smart retail technologies support these models through automated billing, personalized selection, and flexible delivery options.

Market Restraints:

Despite strong growth momentum, the smart retail market faces several challenges that could slow adoption or limit effectiveness.

Data privacy and security concerns loom large as retailers collect increasingly detailed information about customer behavior, preferences, and purchasing patterns. High-profile data breaches have made consumers wary, and regulatory frameworks like GDPR in Europe impose strict requirements on how personal data can be collected and used. Retailers must balance the personalization that customers want with the privacy protections they demand.

Limited internet access and smartphone penetration in developing regions restrict adoption. While smart retail thrives in urban areas with robust digital infrastructure, many rural and developing markets lack the connectivity needed to support these technologies. This digital divide means smart retail's benefits remain out of reach for significant portions of the global population.

Intense competition among free and paid apps affects profitability, particularly for smaller developers trying to break into the market. The expectation that basic features should be free makes it challenging to monetize smart retail applications, while the cost of developing and maintaining sophisticated AI-powered features continues to rise.

Lack of physical supervision in app-based workouts and shopping guidance raises concerns about user safety and satisfaction. Without trained staff to provide guidance, customers may miss out on the personalized service that builds loyalty. Automated systems, no matter how sophisticated, can't fully replace human judgment and intuition in all situations.

Market Key Trends:

Several key trends are shaping the evolution of smart retail and defining its future direction.

Artificial intelligence and machine learning are becoming increasingly central to smart retail operations. These technologies enable personalized workout recommendations, dynamic pricing, real-time inventory optimization, and predictive analytics that help retailers stay ahead of demand curves. As AI capabilities expand, their applications in retail become more sophisticated and valuable.

Integration with wearables and IoT devices is enhancing real-time health monitoring and customer tracking. Smartwatches, fitness trackers, and other connected devices provide retailers with continuous data streams about customer activity and preferences. This real-time information enables more responsive and personalized experiences than ever before.

Hybrid fitness and retail models are gaining traction, combining in-app experiences with live streaming classes and in-person training. This approach gives customers flexibility while maintaining the human connection that builds loyalty. Retailers are discovering that digital and physical experiences work best when thoughtfully integrated rather than kept separate.

Gamification features, social community engagement, and challenges are becoming popular tools to boost user motivation and retention. By turning shopping or fitness activities into games with rewards and social recognition, retailers tap into psychological drivers that keep customers engaged over the long term.

Holistic wellness is expanding smart retail beyond traditional boundaries. Fitness apps now include meditation and nutrition tracking. Retail apps incorporate lifestyle content and community features. This broader approach reflects growing consumer interest in overall wellbeing rather than isolated activities.

Leading Players of Smart Retail Market:

According to IMARC Group's latest analysis, prominent companies shaping the global smart retail landscape include:

- Adroit Worldwide Media Inc.

- Amazon.com Inc.

- Cisco Systems Inc.

- Google LLC (Alphabet Inc.)

- Honeywell International Inc.

- Ingenico

- Intel Corporation

- NCR Corporation

- NVIDIA Corporation

- NXP semiconductors N.V.

- PTC

- Samsung Electronics Co. Ltd.

- Zippin

These leading providers are expanding their footprint through strategic partnerships, rich certification portfolios, and advanced digital platforms to meet growing corporate, academic, and enterprise demands in emerging technologies like cloud computing, cybersecurity, big data, and AI/ML.

Key Developments in Smart Retail Market:

December 2024: Walmart finalized its USD 2.3 Billion purchase of Vizio, incorporating its SmartCast platform to enhance Walmart Connect's retail media functions. Vizio's ad-supported platform, boasting more than 19 Million active accounts, expanded Walmart's reach and enhanced its product discovery capabilities. Vizio now functions as a fully owned subsidiary of Walmart, marking a significant move in retail media and connected TV advertising.

January 2025: Salesforce launched AI agents and cloud-based POS systems for retailers, representing a major advancement in retail technology infrastructure. These systems autonomously handle routine tasks while providing real-time insights to human employees, demonstrating how AI is becoming embedded in core retail operations rather than remaining a supplementary tool.

Late 2024: BirdEye, a Saudi Arabia-based startup, raised USD 586,000 in a pre-seed funding round to fuel its expansion across the Middle East. The platform provides a user-friendly solution aimed at assisting small and medium-sized enterprises in managing their activities and staying competitive in a progressively digital retail landscape, highlighting how smart retail solutions are reaching emerging markets.

2024: Honeywell's AI in Retail Survey revealed that over 80% of retailers planned to broaden automation and AI use, with 35% of leading retailers planning to considerably increase their AI spending. This widespread commitment to AI investment demonstrates industry confidence that these technologies will deliver measurable returns and competitive advantages.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201-971-6302