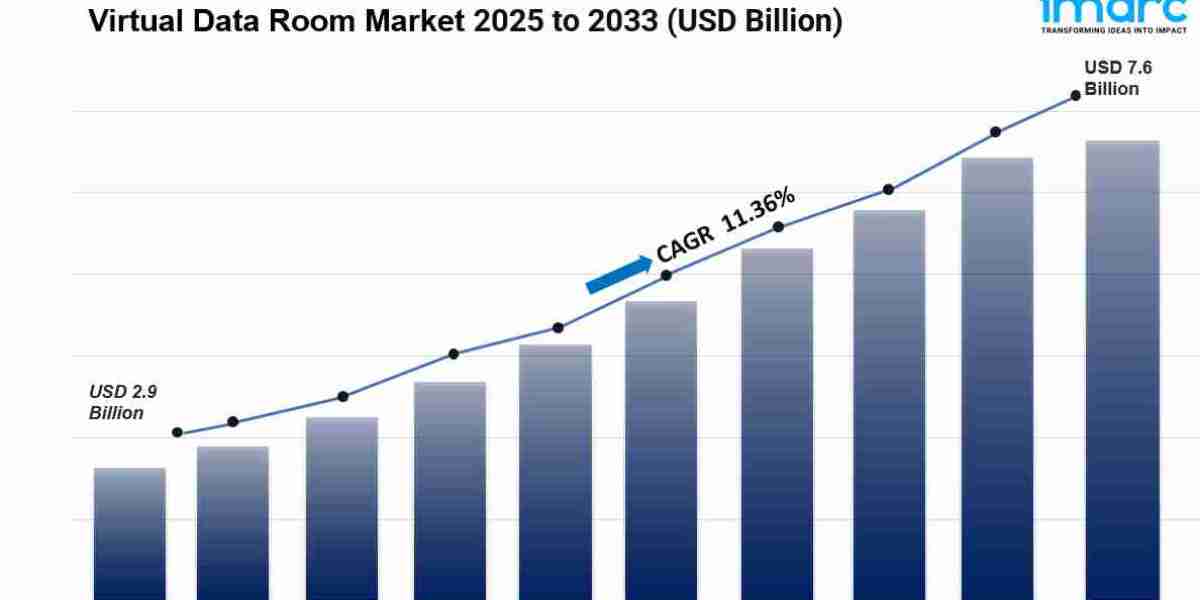

The global virtual data room market size was valued at USD 2.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 7.6 Billion by 2033, exhibiting a CAGR of 11.36% during 2025-2033. North America currently dominates the market, holding a significant market share of over 41.2% in 2024. The market is experiencing steady growth driven by the increasing need for secure data management during mergers and acquisitions, rising adoption of cloud-based solutions across enterprises, and the growing demand for safe document sharing and storage in industries like banking, legal, and healthcare.

Key Stats for Virtual Data Room Market:

- Virtual Data Room Market Value (2024): USD 2.9 Billion

- Virtual Data Room Market Value (2033): USD 7.6 Billion

- Virtual Data Room Market Forecast CAGR: 11.36%

- Leading Segment in Virtual Data Room Market in 2024: Solution (75.0%)

- Key Regions in Virtual Data Room Market: Asia Pacific, Europe, North America, Latin America, Middle East and Africa

- Top companies in Virtual Data Room Market: Ansarada Pty Ltd., Brainloop AG (Diligent Corporation), CapLinked, Citrix Systems Inc., Datasite Global Corporation, DealRoom Inc., EthosData, Firmex Inc, FORDATA sp. z o.o., iDeals Solutions Group, Intralinks Holdings Inc. (SS&C Technologies), SecureDocs Inc., ShareVault (Pandesa Corporation), SmartRoom (BMC Group), etc.

Why is the Virtual Data Room Market Growing?

The virtual data room market is expanding rapidly as businesses across sectors recognize the critical importance of secure data management. Companies dealing with sensitive transactions—whether it's a billion-dollar merger, a fundraising round, or regulatory compliance—need platforms they can trust. Virtual data rooms have become the go-to solution for these high-stakes scenarios.

What's driving this momentum? For starters, mergers and acquisitions activity continues to surge globally. During the third quarter of 2024 alone, total transactions in financial assets in the United States reached USD 201.9 Billion, demonstrating the ongoing appetite for major business deals. Each of these transactions requires secure document sharing, due diligence processes, and confidential information exchange—all core functions of virtual data rooms.

The shift to remote and hybrid work has fundamentally changed how businesses operate. Teams spread across different cities, countries, and time zones need to collaborate on sensitive documents without compromising security. Virtual data rooms solve this challenge by providing controlled access, real-time collaboration features, and comprehensive audit trails that traditional file-sharing methods simply can't match.

Cloud adoption is another major catalyst. According to recent industry reports, end-user cloud spending is projected to increase 21.5% globally to reach USD 723 Billion in 2025. This massive shift to cloud infrastructure is making virtual data rooms more accessible and affordable for companies of all sizes. Small and medium enterprises, in particular, are discovering that they can now access enterprise-grade security features without massive upfront investments.

Regulatory pressure is also playing a significant role. Industries like banking, healthcare, and legal services face increasingly stringent data protection requirements. Virtual data rooms help these organizations maintain compliance while streamlining their operations. The banking, financial services, and insurance sector leads adoption, accounting for 34.0% of the market, precisely because these organizations cannot afford any data security lapses.

The technology itself has evolved considerably. Modern virtual data rooms aren't just digital filing cabinets—they're sophisticated platforms with advanced encryption, granular access controls, and intelligent document organization. Users can track who accessed which documents, when, and for how long. This level of transparency is invaluable during audits or legal proceedings.

Request For A Sample Copy Of This Report: https://www.imarcgroup.com/virtual-data-room-market/requestsample

AI Impact on the Virtual Data Room Market:

Artificial intelligence is fundamentally transforming how virtual data rooms operate and deliver value to users. What used to be a manual, time-consuming process of organizing and reviewing documents is now becoming significantly more efficient through AI-powered automation.

AI investment surged to USD 142.3 Billion in 2023, driven largely by corporate interest and startup funding. This massive influx of capital is fueling rapid innovation across all AI-powered business tools, including virtual data rooms. The technology is no longer experimental—it's becoming standard practice for leading providers.

One of the most impactful applications is intelligent document classification. AI algorithms can automatically analyze uploaded documents, categorize them by type, extract key information, and organize them into the appropriate folders. This saves deal teams countless hours that would otherwise be spent on manual filing. More importantly, it reduces human error and ensures consistent organization across massive document repositories.

Predictive analytics is another game-changer. AI systems can analyze bidder behavior within a data room, identifying patterns that indicate genuine interest versus casual browsing. For companies managing competitive bids, this intelligence is invaluable. According to leading VDR providers like Firmex, Intralinks, Ansarada, and Datasite, their AI-backed solutions provide clients with real-time insights regarding bidder behavior and target zones, giving sellers a strategic advantage during negotiations.

AI-powered risk detection is enhancing security to new levels. These systems can identify anomalies in access patterns, flag potentially suspicious activities, and even detect compliance concerns within documents. This proactive approach to security helps prevent data breaches before they occur rather than simply responding after damage is done.

Natural language processing is making document review dramatically faster. AI can scan through thousands of pages, identify key clauses, extract critical dates and figures, and even highlight potential red flags. Legal teams conducting due diligence can now focus their expertise on actual analysis rather than spending days reading through routine contracts.

Two-factor authentication combined with AI-driven anomaly detection provides layered security that adapts to emerging threats. The system learns normal user behavior patterns and can flag unusual access attempts, adding an intelligent security layer beyond traditional authentication methods.

The latest generation of VDR platforms, like those announced by Ansarada and Imprima, integrate AI throughout the entire deal lifecycle—from initial document upload through post-merger integration. This creates a continuous intelligence thread that makes institutional knowledge more accessible and actionable.

Segmental Analysis:

Analysis by Component:

- Solution

- Services

Solutions dominate the market with a 75.0% share in 2024, providing the core platform and features that organizations rely on for secure data management. Cloud-based VDR solutions are particularly popular because they offer scalability, comprehensive security, and subscription-based pricing that eliminates upfront infrastructure costs. These platforms include advanced features like AI integration, mobile optimization, and compliance certifications that appeal to organizations of all sizes. Recent strategic moves, like Accenture and Google Cloud expanding their global alliance to help organizations safeguard critical assets and enhance security against cyber threats, demonstrate the ongoing investment in cloud-based solutions. The service segment complements this by providing implementation support, training, and ongoing maintenance that ensures organizations maximize their VDR investment.

Analysis by Deployment Type:

- Cloud-based

- On-premises

On-premises solutions continue to hold significant market share, particularly among organizations with the strictest data security and compliance requirements. Banking and healthcare sectors, where regulatory mandates often require data to remain within physical infrastructure, favor on-premises deployments. These organizations prioritize complete control over their sensitive data and are willing to invest in the infrastructure necessary to maintain that control. However, the market is gradually shifting toward cloud-based solutions as security concerns are addressed and the benefits of accessibility, scalability, and lower total cost of ownership become more compelling. Hybrid solutions that combine on-premises security with cloud flexibility are gaining traction as organizations seek the best of both approaches.

Analysis by Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises

Large enterprises command approximately 65.7% of the market share in 2024, driven by their complex data management needs, high-volume transactions, and stringent security requirements. These organizations regularly engage in mergers and acquisitions, major financing rounds, and extensive regulatory compliance activities—all scenarios where virtual data rooms prove indispensable. However, small and medium enterprises are increasingly recognizing the value proposition. In India alone, the number of MSMEs is projected to grow from 6.3 crore to around 7.5 crore at a CAGR of 2.5%, and many of these businesses are adopting VDRs as they scale operations and enter new markets. The subscription-based pricing model makes enterprise-grade security accessible to smaller organizations that previously couldn't justify the investment.

Analysis by Business Function:

- Marketing and Sales

- Legal

- Finance

- Workforce Management

Finance leads the market as the primary business function utilizing virtual data rooms. The finance sector's constant involvement in high-stakes transactions, regulatory reporting, and sensitive document management makes VDRs essential infrastructure. Legal departments follow closely, using VDRs for litigation support, contract management, and due diligence processes. Marketing and sales teams increasingly leverage VDRs for secure sharing of strategic plans, customer data, and competitive intelligence. Workforce management applications include secure onboarding documentation, employee records management, and confidential HR processes.

Analysis by Vertical:

- BFSI

- Retail and E-Commerce

- Government

- Healthcare and Life Sciences

- IT and Telecommunications

- Others

Banking, Financial Services, and Insurance leads with approximately 34.0% market share in 2024, reflecting the sector's critical need for secure data management. There were 784 foreign bank branches in the European Union during 2021, demonstrating the sector's global reach and corresponding need for secure cross-border data sharing. Healthcare and life sciences organizations use VDRs to manage clinical trial data, regulatory submissions, and patient information while maintaining HIPAA compliance. Retail and e-commerce companies, with Latin America alone boasting over 300 Million digital buyers, leverage VDRs for supply chain management, supplier contracts, and secure customer data handling. The IT and telecommunications sector, with expenditure on information and communications technology across the Middle East, Turkey, and Africa reaching USD 238 Billion in 2024 (up 4.5% over 2023), increasingly relies on VDRs for contract management and confidential project documentation.

Request Customization: https://www.imarcgroup.com/request?type=report&id=3828&flag=E

Analysis of Virtual Data Room Market by Regions

![Regional Market Map]

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

North America dominates with a 41.2% market share, powered by advanced technological infrastructure, strong regulatory frameworks, and mature financial and legal industries. The United States alone accounts for 84.50% of the North American market, with 98% of U.S. organizations having adopted cloud technology for business operations. This widespread cloud adoption creates a natural pathway for VDR implementation across sectors.

Asia Pacific represents the fastest-growing region, driven by rapid digital transformation, increasing M&A activity, and expanding financial services sectors. Countries like India and China are experiencing explosive growth in their SME populations, many of which are adopting digital tools including virtual data rooms as they scale.

Europe maintains strong adoption rates, particularly in financial centers like London, Frankfurt, and Paris. The region's stringent data protection regulations (GDPR and others) actually drive VDR adoption as companies seek compliant solutions for cross-border data sharing.

Latin America's market is expanding as the region's e-commerce and financial sectors modernize. The growing base of digital buyers and increasing foreign investment drive demand for secure transaction platforms.

The Middle East and Africa region is experiencing rapid growth, particularly in the IT and telecommunications sector. Government initiatives promoting digital transformation and smart city projects are creating new opportunities for VDR providers.

What are the Drivers, Restraints, and Key Trends of the Virtual Data Room Market?

Market Drivers:

The primary force propelling the virtual data room market forward is the explosive growth in mergers and acquisitions activity worldwide. Every major deal requires extensive due diligence, and virtual data rooms have become the standard infrastructure for managing these complex transactions. Companies can't afford security breaches during billion-dollar negotiations, making VDRs non-negotiable.

Cloud technology adoption continues accelerating across all business sectors. Organizations are moving away from maintaining expensive on-premises infrastructure and embracing the flexibility and scalability of cloud solutions. Virtual data rooms benefit directly from this broader trend, offering subscription-based access to enterprise-grade security without massive capital expenditures.

Remote work has permanently changed business operations. Teams conducting due diligence or managing sensitive projects no longer work from a single office location. They need secure, accessible platforms that allow real-time collaboration across time zones while maintaining strict access controls and audit trails.

Regulatory compliance requirements are becoming more stringent globally. Organizations face heavy penalties for data breaches or non-compliance with regulations like GDPR, HIPAA, and industry-specific mandates. Virtual data rooms help companies meet these requirements through built-in compliance features, encryption standards, and detailed activity logging.

The pharmaceutical sector's growth, with North America holding 49% of the global market, drives significant VDR demand. Drug development, clinical trials, and regulatory approvals all require secure document management and collaboration across multiple stakeholders—exactly what virtual data rooms provide.

Market Restraints:

Data privacy and security concerns, while also being a driver, can act as a restraint. Some organizations, particularly in highly regulated industries, remain hesitant about storing sensitive data in cloud environments. They worry about potential breaches, unauthorized access, or compliance issues with data residency requirements.

Limited internet infrastructure in developing regions restricts adoption. While major cities in emerging markets have excellent connectivity, many smaller cities and rural areas lack the reliable, high-speed internet necessary for effective VDR use. This digital divide limits market expansion in potentially high-growth regions.

The competitive landscape creates pricing pressure. Numerous providers offer similar feature sets, leading to price competition that can squeeze profit margins. Smaller VDR providers struggle to compete with established players who can leverage economies of scale.

Change management challenges shouldn't be underestimated. Organizations accustomed to traditional document management methods may resist transitioning to virtual data rooms. Training requirements, workflow adjustments, and user adoption can slow implementation, particularly in companies with less tech-savvy workforces.

Market Key Trends:

Artificial intelligence integration is the defining trend reshaping the VDR landscape. As mentioned earlier, AI-powered features like automated document classification, predictive analytics, and intelligent risk detection are becoming standard rather than premium add-ons. Providers without robust AI capabilities risk losing market share.

Hybrid deployment models are gaining traction, blending on-premises security with cloud flexibility. Organizations can keep their most sensitive data on local servers while leveraging cloud infrastructure for broader collaboration needs. This approach satisfies security requirements while capturing cloud benefits.

Mobile accessibility is no longer optional—it's expected. Deal teams need to review documents, approve transactions, and respond to queries from anywhere. VDR providers are investing heavily in mobile applications that deliver full functionality without compromising security.

Industry-specific solutions are emerging as providers recognize that different sectors have unique needs. A VDR designed for pharmaceutical companies managing clinical trial data requires different features than one built for real estate transactions. Specialized solutions command premium pricing and generate stronger customer loyalty.

Integration capabilities are increasingly important. Organizations use multiple software platforms—CRM systems, project management tools, communication platforms—and they expect their VDR to integrate seamlessly with existing workflows. Open APIs and pre-built connectors are becoming key differentiators.

Blockchain technology is being explored for enhanced security and verification. Some providers are experimenting with blockchain-based authentication and document verification, creating immutable audit trails that provide additional assurance in high-stakes transactions.

Leading Players of Virtual Data Room Market:

According to IMARC Group's latest analysis, prominent companies shaping the global virtual data room landscape include:

- Ansarada Pty Ltd.

- Brainloop AG (Diligent Corporation)

- CapLinked

- Citrix Systems Inc.

- Datasite Global Corporation

- DealRoom Inc.

- EthosData

- Firmex Inc

- FORDATA sp. z o.o.

- iDeals Solutions Group

- Intralinks Holdings Inc. (SS&C Technologies)

- SecureDocs Inc.

- ShareVault (Pandesa Corporation)

- SmartRoom (BMC Group)

These leading providers are expanding their footprint through strategic partnerships, enhanced AI capabilities, and industry-specific solutions. They're investing heavily in advanced security features, user experience improvements, and mobile accessibility to meet growing demand across financial services, legal, healthcare, and corporate sectors.

Key Developments in Virtual Data Room Market:

- September 2024: IDBI Bank announced that it would grant access to approved bidders for the bank's virtual data room, following the Reserve Bank of India's approval in July. This represents the first strategic disinvestment of a bank with substantial government ownership, targeting completion in FY2024. The move demonstrates how major financial institutions are leveraging VDR technology for complex, high-stakes transactions involving multiple stakeholders and regulatory oversight.

- Recent Development: IBM and Cohesity partnered to address enterprises' increasing needs for data resilience and security in hybrid cloud environments. IBM introduced the IBM Storage Defender service, incorporating Cohesity's data protection as an essential component. IBM Storage Defender combines data management, protection, and cyber resilience capabilities from both companies, designed to help with event monitoring and AI across multiple storage platforms through a single interface. The solution protects enterprise data layers from threats including human errors, ransomware, and sabotage.

- Recent Development: Oracle launched the European Union Sovereign Cloud to support European data privacy and sovereignty requirements. The EU Sovereign Cloud provides Oracle Cloud Infrastructure with identical service level agreements and competitive pricing as Oracle's commercial cloud regions. Located entirely within the EU and separate from Oracle's other cloud regions, it offers customers enhanced control over their data—a critical consideration for organizations evaluating virtual data room solutions within strict European regulatory frameworks.

- Recent Development: Accenture and Google Cloud expanded their global alliance to help organizations protect critical assets and enhance security against evolving cyber threats. Together, they're delivering technology and security expertise to strengthen trusted infrastructures, enabling businesses to develop comprehensive security programs. This partnership demonstrates the growing ecosystem of security solutions that complement and enhance virtual data room capabilities.

- Recent Development: CallCabinet introduced an advanced version of its AI-driven Conversation Analytics, featuring enhanced generative AI integration, an optimized interface, and greater customization options. This update empowers businesses to tailor analytics to their strategic goals, boosting efficiency and fostering cross-departmental engagement with intuitive data insights. While not a VDR provider directly, this development illustrates the broader trend of AI integration across enterprise data management tools.

- Recent Development: Amelia showcased the newest version of its Conversational AI platform at Enterprise Connect 2024. This version utilizes generative AI and deterministic capabilities, allowing organizations to implement virtual agents for customer care applications. The technology demonstrates how AI is being integrated across enterprise platforms, including virtual data rooms, to enhance user experience and operational efficiency.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Speak To An Analyst: https://www.imarcgroup.com/request?type=report&id=3828&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302